IQVIA Holdings Inc. (IQV)

Will IQVIA (IQV) Beat Estimates Again in Its Next Earnings Report?

IQVIA (IQV) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

IQVIA Benefits From Global IT Infrastructure Amid Low Liquidity

The IQV stock gains from its $330-billion addressable market and an enormous trove of data, which is its distinguishing asset.

IQVIA (IQV) Surges 3.0%: Is This an Indication of Further Gains?

IQVIA (IQV) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Iqvia initiated with an Overweight at Stephens

Stephens initiated coverage of Iqvia with an Overweight rating and $250 price target. The firm says the company has "fulfilled the promise" of combining a leading contract research organization and the largest life science data repository to connect intelligence that advances healthcare. The analyst views the company's Q3 reset, as well as the recent outline of "reasonably conservative" fiscal 2025 and long-term growth frameworks, as creating an attractive setup "for a well-run industry bellwether."

IQVIA Holdings: Share Price Disconnected From Growth Outlook

IQVIA continues to outperform earnings expectations, despite a 14% stock decline, driven by concerns of a CRO industry slowdown and reduced early-stage R&D spending. Q3 results show strong performance with $3.9B revenue, 14.1% EPS growth, and a $31.1B backlog, reinforcing long-term growth potential. Analysts project slower CRO growth, but IQVIA's leadership, consistent earnings, and long-term revenue estimates of $28.45B by 2033 support a bullish outlook.

Why You Should Retain IQVIA Holdings Stock in Your Portfolio Now

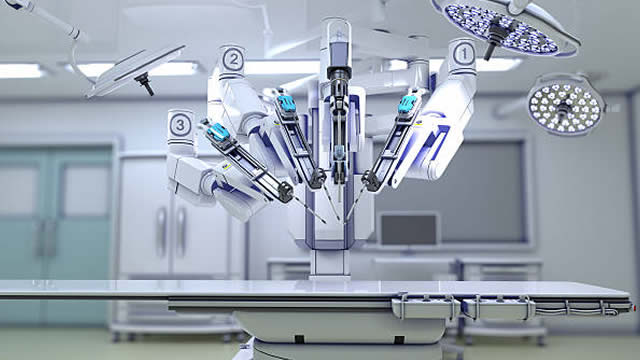

IQV is known for its innovative use of technology and data analytics.

Interpreting IQVIA (IQV) International Revenue Trends

Evaluate IQVIA's (IQV) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

IQVIA (IQV) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for IQVIA (IQV) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

IQVIA Holdings Inc. (IQV) Q3 2024 Earnings Call Transcript

IQVIA Holdings Inc. (NYSE:IQV ) Q3 2024 Results Conference Call October 31, 2024 9:00 AM ET Company Participants Kerri Joseph - Senior Vice President, Investor Relations & Treasury Ari Bousbib - Chairman and Chief Executive Officer Ron Bruehlman - Executive Vice President and Chief Financial Officer Eric Sherbet - Executive Vice President and General Counsel Mike Fedock - Senior Vice President, Financial Planning and Analysis Gustavo Peroni - Senior Director, Investor Relations Conference Call Participants Ann Hynes - Mizuho Shlomo Rosenbaum - Stifel Anne Samuel - JP Morgan Luke Sergott - Barclays Bank Justin Bowers - Deutsche Bank David Windley - Jefferies Elizabeth Anderson - Evercore ISI Michael Cherny – Leerink Partners Operator Ladies and gentlemen, thank you for standing by. At this time, I would like to welcome everyone to the IQVIA Third Quarter 2024 Earnings Conference Call.

IQVIA Earnings & Revenues Surpass Estimates in Q3, Increase Y/Y

Strength in the Research and Development, and Technology and Analytics segments drives IQV's top line in the third quarter of 2024.

IQVIA lowers annual revenue forecast amid trial delays

Contract research firm IQVIA lowered its annual revenue forecast on Thursday, due to delays in two clinical trials as one of its clients faces logistical challenges.

IQVIA Holdings (IQV) Q3 Earnings and Revenues Beat Estimates

IQVIA Holdings (IQV) came out with quarterly earnings of $2.84 per share, beating the Zacks Consensus Estimate of $2.81 per share. This compares to earnings of $2.49 per share a year ago.