Ingersoll-Rand Inc. (IR)

Ingersoll Rand Q4 Review: Strong Pipeline, But Strategy Is Not Appealing For Now

Ingersoll Rand Inc. reported solid Q4 results, with sales up 10.6% and strong cash flow, but most growth was M&A-driven. IR's aggressive acquisition strategy underpins its long-term compounding thesis, yet organic growth remains modest and margin accretion uncertain. Management's 2026 guidance implies only 3.5% sales growth and slight EBITDA/EPS misses versus consensus, raising questions about the sustainability of bolt-on growth.

Ingersoll Rand Inc. (IR) Q4 2025 Earnings Call Transcript

Ingersoll Rand Inc. (IR) Q4 2025 Earnings Call Transcript

Ingersoll Rand's Q4 Earnings & Revenues Top Estimates, Up Y/Y

IR posts a solid Q4 beat with double-digit revenue growth and rising orders, backed by acquisitions and organic gains.

Ingersoll (IR) Reports Q4 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Ingersoll (IR) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Ingersoll Rand (IR) Surpasses Q4 Earnings and Revenue Estimates

Ingersoll Rand (IR) came out with quarterly earnings of $0.96 per share, beating the Zacks Consensus Estimate of $0.91 per share. This compares to earnings of $0.84 per share a year ago.

Wall Street's Insights Into Key Metrics Ahead of Ingersoll (IR) Q4 Earnings

Evaluate the expected performance of Ingersoll (IR) for the quarter ended December 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Ingersoll Rand (IR) Reports Next Week: Wall Street Expects Earnings Growth

Ingersoll (IR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Ingersoll (IR) Surges 5.4%: Is This an Indication of Further Gains?

Ingersoll (IR) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Ingersoll Rand Inc. (IR) Presents at 44th Annual J.P. Morgan Healthcare Conference Transcript

Ingersoll Rand Inc. (IR) Presents at 44th Annual J.P. Morgan Healthcare Conference Transcript

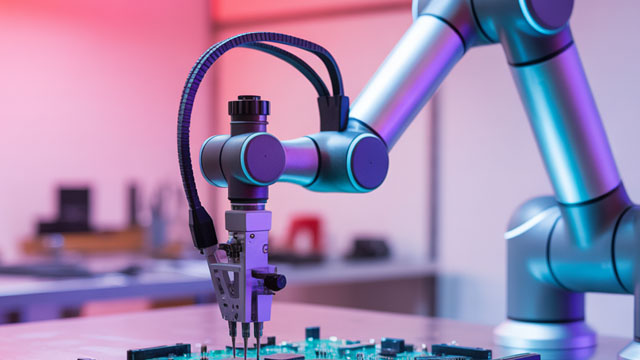

Ingersoll Rand Acquires Scinomix, Strengthens Life Sciences Portfolio

IR strengthens its life sciences platform by acquiring Scinomix, adding automation workflow technologies for labs and pharma markets.

Here's Why You Should Retain Ingersoll Rand in Your Portfolio

IR sees order growth and acquisitions lift 2025 outlook, while cash flow supports buybacks despite rising costs.

Reasons Why You Should Avoid Betting on Ingersoll Rand Right Now

IR struggles with rising costs, mounting debt and currency headwinds, pressuring profitability and investor sentiment.