JPMorgan Chase & Co. (JPM)

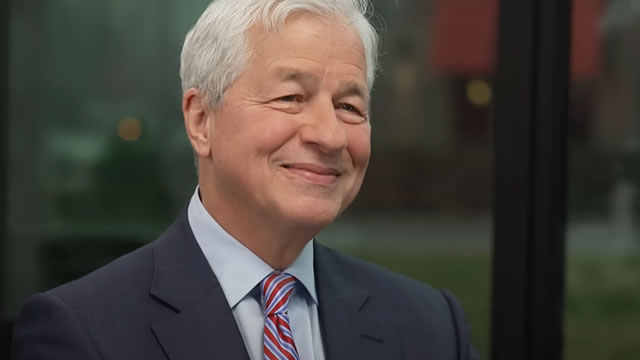

Jamie Dimon says 'watch out' as high asset prices add to economic risks: ‘My anxiety is high'

Even as economists tout the Trump administration's tax and deregulatory policies as boosting economic growth this year, JPMorgan Chase CEO Dimon said that his own tendencies were to consider what could go wrong when expectations are riding high. "My own view is people are getting a little comfortable that this is real, these high asset prices and high volumes, and that we won't have any problems," said Dimon, who was dressed in black and had a brace on one of his hands.

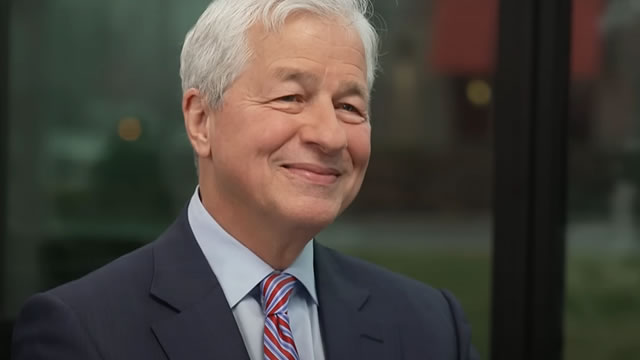

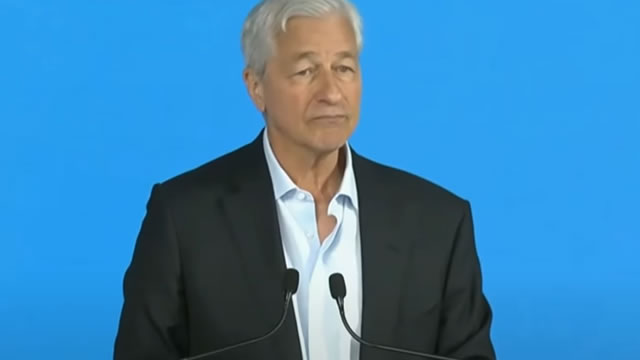

JPMorgan's Dimon Positions AI as Competitive Banking Battleground

JPMorgan Chase's latest company update, on Monday (Feb. 23) underscored that the firm's technology agenda now extends well beyond internal productivity initiatives. Across the presentation and the question-and-answer session, executives consistently positioned artificial intelligence as a central component of competitive strategy, client engagement, with a long-term investment horizon.

Jamie Dimon Dismisses Fears Over How AI Will Hit JPMorgan

The bank's top executives held an in-person update with investors in Manhattan after some 20 inches of snow fell in the city.

Why JPMorgan Chase & Co. (JPM) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why JPMorgan Chase & Co. (JPM) is a Top Stock for the Long-Term

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

JPMorgan's EU Arm Fined EURO 12.18M by ECB for Capital Errors

JPM's European unit faces a EURO 12.18M ECB fine after years of misreporting risk-weighted assets and capital data, citing serious control lapses.

JPMorgan Bets on Branches: How Will This Translate to Revenue Growth?

JPM plans 160+ new branches in 2026, to drive deposits, cross-selling and revenue beyond net interest income.

JPMorgan Wants to Open 160 Branches in 2026

J.P. Morgan Chase is reportedly planning a 160-location wave of branch openings this year. That's according to a Wednesday (Feb. 18) report from the Financial Times (FT), which characterizes the effort as part of a larger push by American lenders to address consumers' desire for in-person banking.

JPMorgan's Q4 Loan Trajectory: Where Did Expansion Show Up?

JPM's Q4 2025 loans hit $1.49T as wholesale and card balances led the surge, and an Apple Card issuer deal could add about $20B.

JPMorgan Chase & Co. (JPM) is Attracting Investor Attention: Here is What You Should Know

JPMorgan Chase & Co. (JPM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Is JPMorgan Chase & Co. (JPM) Up 1% Since Last Earnings Report?

JPMorgan Chase & Co. (JPM) reported earnings 30 days ago. What's next for the stock?

JPMorgan vs. Truist Financial: Which Bank Stock Will Win in 2026?

Does JPM's scale, fee-growth tailwinds and projected 2026 NII gain set it up to outpace TFC, despite a pricier valuation and lower yield? Let's find out.