JPMorgan Chase & Co. (JPM)

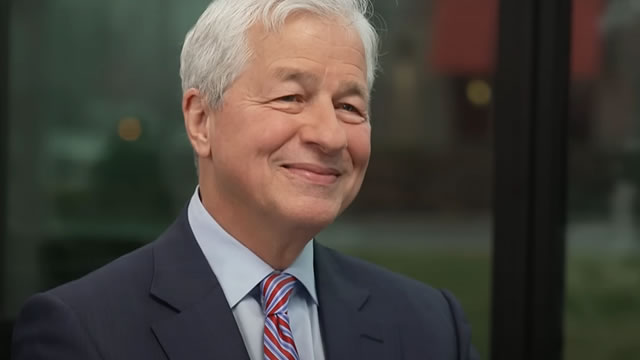

JPMorgan CEO Jamie Dimon says his retirement is ‘several years away'

JPMorgan CEO Jamie Dimon said his gig isn't up at America's largest bank on Monday, insisting in an exclusive interview with Fox Business that his retirement is “several years away.” The bank's succession planning has been under scrutiny on Wall Street in recent months as Dimon approaches two decades in the top job.

JPMorgan: Built For Volatility, Poised For Growth

JPMorgan's resilience, diversified income, and technological leadership make it my top pick for stability and growth in the banking sector. Strong Q1 2025 results, robust credit quality, and proactive risk management highlight JPMorgan's ability to thrive in uncertain economic conditions. Aggressive investments in AI and cloud deliver efficiency gains, giving JPMorgan a clear edge over peers still lagging in digital transformation.

JPMorgan Chase & Co. (JPM) is Attracting Investor Attention: Here is What You Should Know

JPMorgan Chase & Co. (JPM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

JPM Expanding Footprint to Serve Affluent Clients: Buy, Sell or Hold?

Does JPMorgan's premium client focus and strong balance sheet make it a portfolio-worthy pick amid market uncertainty? Let's find out.

JPMorganChase Accelerates Rollout of Branch Format Catering to Affluent Clients

JPMorganChase is accelerating the rollout of the affluent banking offering it introduced late last year. Two of these J.P.

Here's Why JPMorgan Chase & Co. (JPM) Gained But Lagged the Market Today

JPMorgan Chase & Co. (JPM) closed the most recent trading day at $265.29, moving +1.76% from the previous trading session.

'GO AT IT': JPMorgan's Jamie Dimon okays bitcoin trading despite being a critic

'The Big Money Show' weighs in on JPMorgan CEO Jamie Dimon's policy regarding bitcoin trading, the Senate advancing the GENIUS Act and cryptocurrency under the Trump administration. #foxbusiness #jamiedimon #geniusact #cryptocurrency

JPM to Boost Middle East Presence With Hiring of More Than 100 Staff

JPMorgan is set to expand in the Middle East with plans to hire more than 100 staff. This will increase its regional workforce from 370 to nearly 500 in the upcoming years.

JPMorgan Chase & Co. (JPM) Is a Trending Stock: Facts to Know Before Betting on It

JPMorgan Chase & Co. (JPM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

JPMorgan CEO Jamie Dimon clears Bitcoin for bank

JPMorgan Chase CEO Jamie Dimon is putting his personal feelings aside on Bitcoin, the largest crypto by market value, allowing the bank's clients to buy the crypto.

JPM Investor Day Conference: Q2 IB Fees to Dip, 2025 NII May Rise by $1B

Tariff and its economic implications remain in focus during JPMorgan's Investor Day as it expects Q2 IB fees to decline because of ambiguity.

Dimon: Markets Showing ‘Extraordinary Amount of Complacency' Amid Growing Risks

JPMorgan Chase CEO Jamie Dimon said Monday (May 19) that the markets have not accounted for the risks of inflation, stagflation, credit spreads, tariffs and other challenges.