JPMorgan Chase & Co. (JPM)

JPMorgan names David Bauer co-head of ECM Americas

JPMorgan Chase has named David Bauer as its new co-head of equity capital markets in the Americas, according to an internal memo seen by Reuters on Wednesday.

Is JPM Stock Still a Buy After Offering a Weak 2025 NII Outlook?

JPM projects lower NII for 2025 because of interest rate cuts. Let's analyze whether the stock is worth investing in despite NII concerns.

Wall Street Analysts See JPMorgan Chase & Co. (JPM) as a Buy: Should You Invest?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Watch These JPMorgan Price Levels After Stock Posts Biggest Drop Since 2020

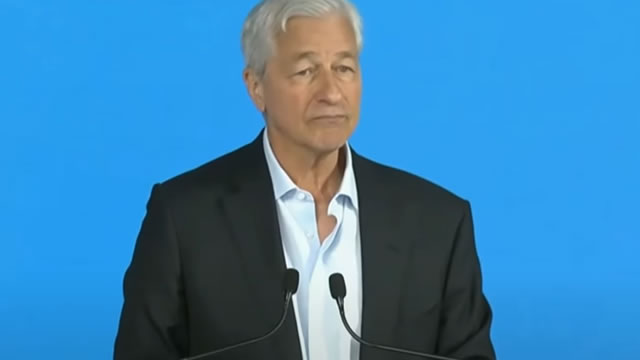

JPMorgan Chase (JPM) shares dropped more than 5% on Tuesday, recording their largest one-day decline since June 2020, after the bank's president said Wall Street's expectations for net interest income and expenses in 2025 were overly optimistic amid impending interest rate cuts and lingering inflation.

JPMorgan stock plummets 7.5% after president Pinto's ‘Elon Musk moment'

President Daniel Pinto has suggested that next year's Wall Street expectations are too optimistic, sending the stock to its worst single day decline since June 2020.

JPMorgan Chase & Co. (JPM) Barclays Global Financial Services Conference 2024 (Transcript)

JPMorgan Chase & Co. (NYSE:JPM ) Barclays Global Financial Services Conference 2024 September 10, 2024 9:45 AM ET Company Participants Daniel Pinto - President and Chief Operating Officer Unidentified Analyst Moving right along, very pleased to have JPMorgan Chase with us once again from the company we have Daniel Pinto, President and Chief Operating Officer. Daniel, thank you.

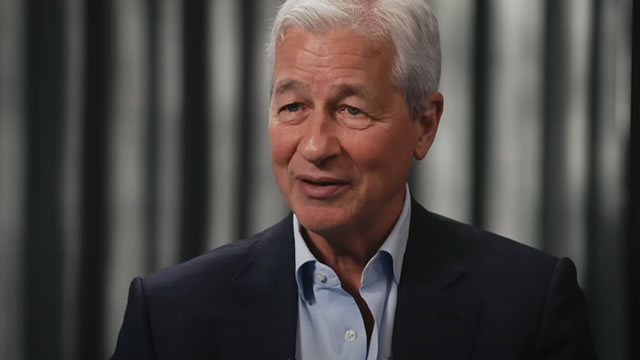

JPMorgan's Jamie Dimon says bank has many ‘extremely' qualified execs for next CEO

Jamie Dimon previously signaled his timeline for stepping down is no longer five years and could be as soon as two-and-a-half years.

JPMorgan sees 15% jump in investment banking fees in third quarter

JPMorgan Chase's investment banking fees could climb 15% in the third quarter, its president and chief operating officer Daniel Pinto said on Tuesday.

Jamie Dimon says 'the worst outcome is stagflation,' a scenario he's not taking off the table

JPMorgan Chase CEO Jamie Dimon said Tuesday he wouldn't rule out stagflation. Dimon's comments come at a time when investors are turning their attention to signs of slowing growth as inflation has shown signs of cooling.

JPMorgan CEO Jamie Dimon says succession is his most important task

JPMorgan Chase is focused on succession planning and has a cadre of "extremely" qualified people who are prepared to run the company, CEO Jamie Dimon said on Tuesday.

Why JPMorgan Chase & Co. (JPM) is a Top Dividend Stock for Your Portfolio

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does JPMorgan Chase & Co. (JPM) have what it takes?

JPMorgan appoints Garcia-Salas, Redmond for mid-cap investment banking

JPMorgan Chase & Co has hired Humberto Garcia-Salas and Andrew Redmond as managing directors for its Mid-Cap Investment Banking division, as it seeks to further strengthen its investment banking segment, according to a memo seen by Reuters.