Kroger Co. (KR)

Here's Why Kroger (KR) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Kroger (KR) is a Top-Ranked Momentum Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

2 Supermarket Stocks in the Spotlight Amid Industry Challenges

While the supermarket industry struggles, WMT and KR stand out with strong digital plays and strategic cost management.

Kroger Rewards Shareholders With 9% Increase in Quarterly Dividend

KR hikes its quarterly dividend by 9%, marking 19 straight years of increases as free cash flow stays strong.

Kroger's Next Chapter: Navigating The Post-Merger Landscape

Kroger raised guidance, focusing on cost cuts, e-commerce profitability, and capital efficiency post-Albertsons deal breakup. Kroger's normalized EPS beat expectations; revenue missed slightly but future growth outlook remains positive. Owner earnings model suggests fair value near $91, well above current market price.

Grocery giant Kroger to close 60 stores in next 18 months

Kroger plans to close 60 stores over the next 18 months. Affected employees will be offered positions at other locations, the grocer said.

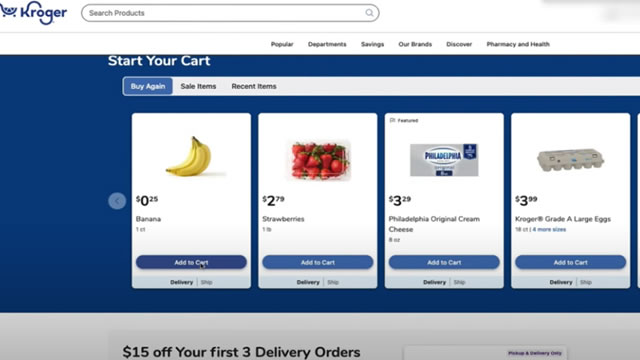

Kroger's Q1 Earnings Beat Estimates, E-commerce Sales Rise 15% Y/Y

KR tops Q1 earnings estimates as e-commerce sales jump 15% and strength in fresh, pharmacy and digital lifts outlook.

Kroger to shutter 60 stores following shock ouster of CEO, failed merger

The chain, which operates more than 1,200 stores, said it took on a $100 million impairment charge related to the planned closures in the first quarter.

Kroger Stock Confirms Buy Signal as Uptrend Gains Strength

Kroger's NYSE: KR stock price entered an uptrend in early 2024 when it became clear it would emerge from the Albertsons merger talks a winner, regardless of how they turned out. Now, months later, the company is moving forward, growing, generating solid cash flows, and returning capital to shareholders like mad.

S&P 500 Gains and Losses Today: Kroger Stock Soars, Accenture Shares Drop

Major U.S. equities indexes were mixed on the day after the Juneteenth holiday, wrapping up the shortened trading week. The fighting between Israel and Iran remained in focus as President Donald Trump pointed to a two-week time frame for a decision on potential U.S. involvement in the conflict.

Kroger: Investing In Digital Channel And Fresh Category, Initiating With Buy

The Kroger Co.'s Q1 FY25 results showed accelerating growth in pharmacy, eCommerce, and fresh categories, supporting my Buy rating with a fair value of $80 per share. Management's focus on digital and fresh categories, alongside operational efficiencies, is driving improved same-store sales and margin expansion. Despite losing market share to Costco and Walmart, Kroger's investments in e-commerce and logistics are starting to yield results, with digital sales up 10% in FY24.

The Kroger Co. (KR) Q1 2025 Earnings Call Transcript

The Kroger Co. (NYSE:KR ) Q1 2025 Earnings Conference Call June 19, 2025 10:00 AM ET Company Participants David John Christopher Kennerley - Executive VP & CFO Robinson C. Quast - Vice President of Investor Relations Ronald L.