Lam Research Corporation (LRCX)

Why Is Lam Research (LRCX) Up 9.8% Since Last Earnings Report?

Lam Research (LRCX) reported earnings 30 days ago. What's next for the stock?

Earnings Growth & Price Strength Make Lam Research (LRCX) a Stock to Watch

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Lam Research Stock Trades at Low P/E: Should You Buy, Sell or Hold?

Despite robust growth in AI and HPC, LRCX faces near-term risks tied to China sales and chip cycle swings.

Here's Why Lam Research (LRCX) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

These 2 Computer and Technology Stocks Could Beat Earnings: Why They Should Be on Your Radar

Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

Why Lam Research (LRCX) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

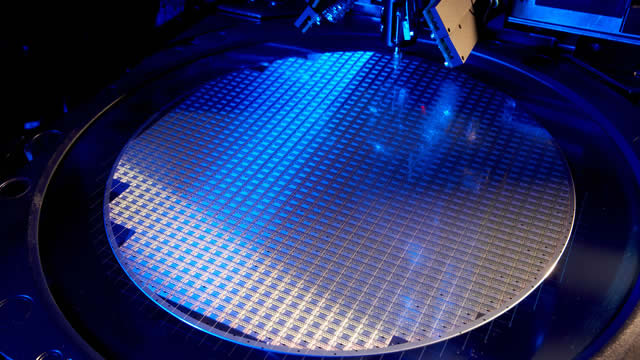

LRCX's ALD Moly Adoption Ramps Up: Will it be a Key Growth Driver?

Lam Research's early lead in ALD molybdenum tools positions it to gain share in advanced chipmaking for NAND and AI-driven logic.

LRCX vs. AMAT: Which Chip-Equipment Stock Is a Better Buy Right Now?

Applied Materials' diversified portfolio, resilient growth and lower valuation give it the edge over Lam Research in the AI-driven chip boom.

International Markets and Lam Research (LRCX): A Deep Dive for Investors

Explore Lam Research's (LRCX) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Why Lam Research (LRCX) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Compared to Estimates, Lam Research (LRCX) Q4 Earnings: A Look at Key Metrics

The headline numbers for Lam Research (LRCX) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Lam Research Blows FY2025 Out Of The Water But AH Trading Shows Caution

Lam Research delivered explosive growth to round off FY2025 with solid guidance for Q1-2026 (September). The company has beaten the market on both 3Y, 5Y, 10Y horizon and I expect it to continue delivering outsized returns but is trading at upper range of historical valuation. China worries dampened investor enthusiasm in the after hours trading originally up 5% and then down 5% with worry for growth normalization.