Lam Research Corporation (LRCX)

2025 will be 'pretty strong' for chips: Lam Research

Uncertainty continues to cloud the semiconductor sector, with investors wary of the potential impacts of stricter US export controls and President Trump's proposed tariffs. Despite these concerns, Doug Bettinger, CFO of Lam Research, points out that current regulations don't seem to impact demand significantly.

Lam Research (LRCX) Boasts Earnings & Price Momentum: Should You Buy?

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

This Semiconductor Stock Is Skyrocketing, and It's Incredibly Cheap Right Now

Semiconductor manufacturing equipment supplier Lam Research (LRCX 1.25%) has been in fine form on the stock market in 2025, with the share price up 22% year to date as of Feb. 19, and the company's recent quarterly results played a key role in driving this rally.

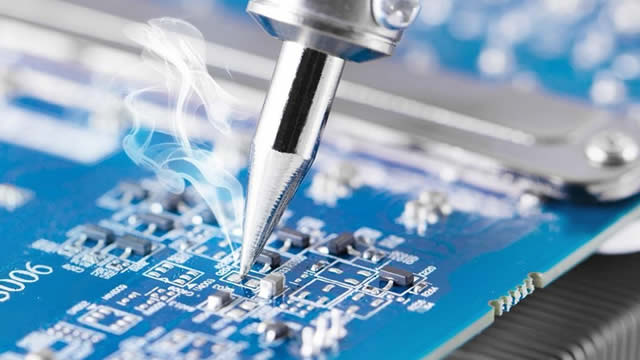

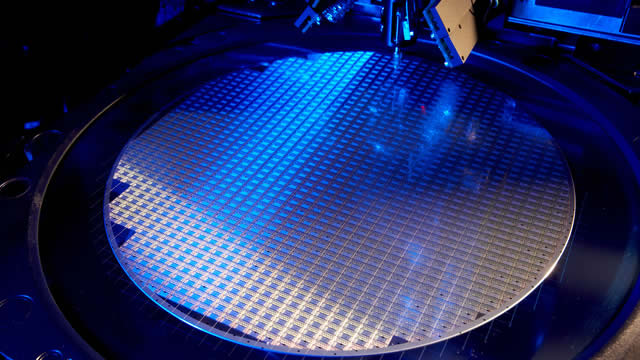

Lam Research unveils two new chipmaking tools for AI chips

Lam Research on Wednesday introduced two new tools for building advanced artificial intelligence chips, as the chipmaking tools supplier aims to benefit from a growing AI-driven semiconductor demand.

Lam Research shares rise after executives reveal financial model at investor day

Lam Research executives gave a company update to investors on Wednesday and shares jumped as much as 3% during the roughly two-and-a-half hour presentation in New York.

3 Brilliant Growth Stocks to Buy Now and Hold for the Long Term

Are you on the hunt for a few good growth stocks? Here's a little secret: The longer you can hold them, the more likely you are to reap their full reward.

US chip toolmaker Lam Research to invest over $1 billion in India

U.S.-based chip toolmaker company Lam Research said it will invest over 100 billion rupees ($1.2 billion) in the next few years in India's southern Karnataka state, the latest boost to the nation's plans to bolster its semiconductor ecosystem.

Lam Research: Is a NAND Upgrade Cycle the Next Growth Catalyst?

Shares of semiconductor equipment maker Lam Research NASDAQ: LRCX are off to a hot start in 2025. Around half of the stock's 15% gain on the year came the day after its full-year 2024 earnings release.

Investors Heavily Search Lam Research Corporation (LRCX): Here is What You Need to Know

Zacks.com users have recently been watching Lam Research (LRCX) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Lam Research (LRCX) is a Top Stock for the Long-Term

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

2 Stock-Split AI Stocks to Buy Before They Soar in 2025, According to Wall Street

Nvidia (NVDA -2.84%) and Lam Research (LRCX -1.06%) play important roles in the artificial intelligence (AI) supply chain. Both stocks outperformed the S&P 500 during the last five years, and both companies reset their soaring share prices with stock splits in 2024.

Why Lam Research (LRCX) International Revenue Trends Deserve Your Attention

Explore Lam Research's (LRCX) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.