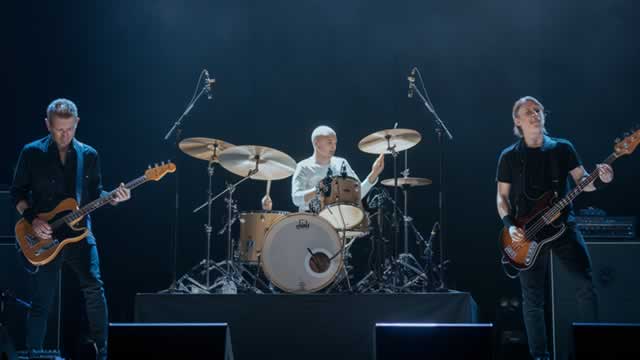

Live Nation Entertainment, Inc. (LYV)

LYV's Concert Demand Remains Strong: Can it Handle Rising Costs?

Live Nation rides strong concert demand and ticketing growth, but rising production costs can squeeze 2025 profitability.

Live Nation Sour Notes Provide Static: Overvalued And Debt-Heavy, It's Time To Sell

I believe the vastly overbought shares of Live Nation Entertainment, Inc. reveal an emotional tug, a larger-than-usual affinity for the pop culture concerts they have built. If the DOJ's lawsuit should prevail against Live Nation, it is likely that we will see a split up between LYV and its Ticketmaster unit. I cannot dismiss LYV stock's overbought status at $144 when the Sword of Damocles swings as low as it is because of the DOJ threat.

Live Nation Entertainment: Better Growth Strength And Visibility With Lower Valuation (Rating Upgrade)

Upgraded Live Nation Entertainment to a buy due to improved growth visibility, accelerating ticket sales, record deferred revenue, and strong international and margin execution. 1Q25 earnings showed solid margin execution despite a soft top-line, with significant improvements in the Concerts segment and strong international market performance. Deferred revenue and international growth are key drivers, with record ticket sales and new venue openings enhancing vertical integration and profitability.

Live Nation's Q1 Loss Narrower Than Expected, Revenues Down Y/Y

LYV's first-quarter 2025 results reflect a decline in Concerts and Ticketing revenues.

Here's What Key Metrics Tell Us About Live Nation (LYV) Q1 Earnings

While the top- and bottom-line numbers for Live Nation (LYV) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Live Nation Entertainment, Inc. (LYV) Q1 2025 Earnings Call Transcript

Live Nation Entertainment, Inc. (NYSE:LYV ) Q1 2025 Earnings Conference Call May 1, 2025 5:00 PM ET Company Participants Amy Yong - Head, IR Michael Rapino - President & CEO Joe Berchtold - President & CFO Conference Call Participants Brandon Ross - LightShed Partners David Karnovsky - J.P. Morgan Stephen Laszczyk - Goldman Sachs Cameron Mansson-Perrone - Morgan Stanley Peter Henderson - Bank of America Benjamin Soff - Deutsche Bank Kutgun Maral - Evercore ISI David Joyce - Seaport Research Partners Operator Good afternoon.

Live Nation (LYV) Reports Q1 Loss, Lags Revenue Estimates

Live Nation (LYV) came out with a quarterly loss of $0.32 per share versus the Zacks Consensus Estimate of a loss of $0.34. This compares to loss of $0.53 per share a year ago.

Live Nation posts lower-than-expected first quarter revenue

Ticketmaster-parent Live Nation Entertainment missed Wall Street estimates for first-quarter revenue on Thursday, hurt by higher concert ticket prices amid economic uncertainty.

Live Nation says ticket sales are outpacing last year despite worries about economy, but sales miss estimates

Ticketmaster parent Live Nation reported results as analysts try to parse the impact of a higher cost of living, compounded by a global trade war, on concert demand.

Live Nation Gears Up to Report Q1 Earnings: What's in the Offing?

LYV's first-quarter 2025 results are likely to reflect the impacts of strong ticket sales, robust sponsorship growth and a rise in average per-fan spending.

Unveiling Live Nation (LYV) Q1 Outlook: Wall Street Estimates for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Live Nation (LYV), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2025.

The Headline Act at Live Nation's Las Vegas Pop-Punk Festival? 7-Eleven

The concert promoter is capitalizing on brands' desire to get closer to live culture, allowing them to buy their way into a festival's name.