Microchip Technology Incorporated (MCHP)

Microchip Q2 Earnings Beat Estimates, Sales Down Y/Y, Shares Drop

MCHP's fiscal Q2 earnings beat estimates despite lower sales and margins, as the chipmaker eyes a mild revenue dip next quarter.

Microchip Tech (MCHP) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Microchip Tech (MCHP) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Microchip Technology (MCHP) Q2 Earnings and Revenues Top Estimates

Microchip Technology (MCHP) came out with quarterly earnings of $0.35 per share, beating the Zacks Consensus Estimate of $0.33 per share. This compares to earnings of $0.46 per share a year ago.

Microchip to Report Q2 Earnings: What's in Store for the Stock?

MCHP eyes modest Q2 revenue growth as inventory cuts, design wins, and strong demand in aerospace and AI drive optimism.

Insights Into Microchip Tech (MCHP) Q2: Wall Street Projections for Key Metrics

Get a deeper insight into the potential performance of Microchip Tech (MCHP) for the quarter ended September 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Microchip Technology: The Turnaround Is Taking Hold, But Market Is Skeptical

Microchip Technology is undergoing a visible turnaround under returning CEO Steve Sanghi, with improving margins and renewed growth momentum. MCHP's Nine-Point Recovery Plan is driving operational discipline, inventory reduction, and cost control, supporting a rebound in earnings and cash flow. Growth drivers include aerospace & defense, AI ecosystem components, and an industrial/automotive recovery, while dividend sustainability is now backed by cash flow.

Semiconductor stocks still have plenty of growth ahead: analysts

US semiconductor stocks have “plenty of room to go” from a margin, revenue, inventory and demand perspective, Citi analysts wrote in a note to clients on Friday. They said while valuation appears to be extreme, it can be explained by artificial intelligence (AI), which is resulting in accelerating growth via higher pricing in semiconductors for the first time in 25 years.

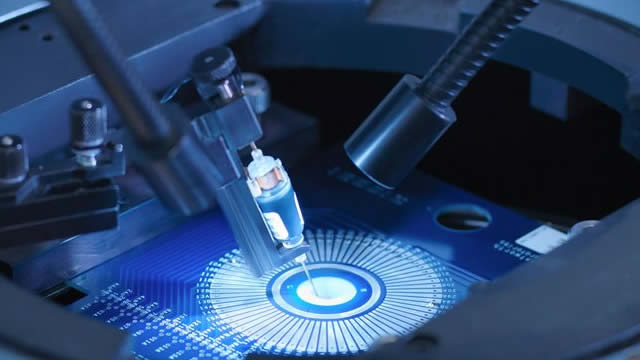

Microchip Broadens Offerings With Robust Portfolio Expansion

MCHP strengthens its portfolio with MCP9604 IC, AI tools and FPGA advances, targeting growth across key industries.

Microchip Technology Incorporated (MCHP) Presents at KeyBanc Technology Leadership Forum Conference Transcript

Microchip Technology Incorporated (NASDAQ:MCHP ) KeyBanc Technology Leadership Forum Conference August 12, 2025 1:30 PM ET Company Participants James Eric Bjornholt - Senior Corporate Vice President & CFO Conference Call Participants John Nguyen Vinh - KeyBanc Capital Markets Inc., Research Division John Nguyen Vinh Okay. Good morning.

Investing in Microchip Tech (MCHP)? Don't Miss Assessing Its International Revenue Trends

Evaluate Microchip Tech's (MCHP) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

Microchip Q1 Earnings Beat Estimates, Sales Down Y/Y, Shares Drop

MCHP's Q1 earnings and sales beat estimates despite steep yearly declines, with Q2 guidance signaling sequential growth ahead.

Microchip Technology Incorporated (MCHP) Q1 2026 Earnings Call Transcript

Microchip Technology Incorporated (NASDAQ:MCHP ) Q1 2026 Earnings Conference Call August 7, 2025 5:00 PM ET Company Participants O - Corporate Participant James Eric Bjornholt - Senior Corporate Vice President & CF Richard J. Simoncic - Chief Operating Officer Stephen Sanghi - CEO, President & Chair of the Board Conference Call Participants Blayne Peter Curtis - Jefferies LLC, Research Division Christopher Caso - Wolfe Research, LLC Christopher Adam Jackson Rolland - Susquehanna Financial Group, LLLP, Research Division Christopher Brett Danely - Citigroup Inc., Research Division Harlan L.