Medtronic plc (MDT)

Beverly Hills surgeon sues Medtronic for patent infringement

A Beverly Hills surgeon is suing Medtronic claiming patent infringement of her hernia repair mesh product. It's the latest in a series of patent challenges against Medtronic.

Medtronic (MDT) Stock Sinks As Market Gains: Here's Why

The latest trading day saw Medtronic (MDT) settling at $87.72, representing a -0.45% change from its previous close.

Medtronic Stock Trading at a Discount Before Q2 Earnings: Time to Buy?

Like its peers, the impact of the present geopolitical situation may have curbed fiscal second-quarter profits for Medtronic.

2 Dividend Stocks to Buy for a Lifetime of Passive Income

These are the kinds of stocks that can allow investors to sleep easy at night.

Medtronic (MDT) Outperforms Broader Market: What You Need to Know

Medtronic (MDT) reachead $90.07 at the closing of the latest trading day, reflecting a +0.92% change compared to its last close.

Medtronic (MDT) Ascends But Remains Behind Market: Some Facts to Note

In the most recent trading session, Medtronic (MDT) closed at $90.60, indicating a +0.01% shift from the previous trading day.

Medtronic (MDT) Increases Despite Market Slip: Here's What You Need to Know

Medtronic (MDT) closed the most recent trading day at $91.12, moving +0.1% from the previous trading session.

MDT vs. ABT: Which Stock Is the Better Value Option?

Investors looking for stocks in the Medical - Products sector might want to consider either Medtronic (MDT) or Abbott (ABT). But which of these two companies is the best option for those looking for undervalued stocks?

Medtronic (MDT) Rises Yet Lags Behind Market: Some Facts Worth Knowing

In the latest trading session, Medtronic (MDT) closed at $89.36, marking a +0.57% move from the previous day.

Medtronic: Undervalued Dividend Aristocrat With High Margins

Medtronic remains an attractive investment due to its diversified revenue streams, robust product pipeline and improving margins. MDT's growth is driven by strong performance in Neuroscience, Cardiovascular, and Diabetes care, with significant international revenue growth and a promising product pipeline. Trading below its historical valuation, MDT offers a compelling opportunity for conservative investors seeking quality at a reasonably low price.

MDT Stock Trades Near 52-Week High: Is it a Smart Buy Now?

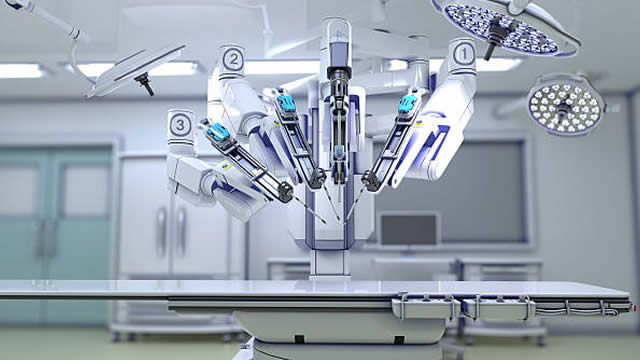

The latest rate cut should help Medtronic expand in the AFib, structural heart, robotics, neuromodulation, hypertension and diabetes markets.

The Zacks Analyst Blog JPMorgan, Medtronic, Shopify and Perma-Pipe International

JPMorgan, Medtronic, Shopify and Perma-Pipe International are included in this Analyst Blog.