Medtronic plc (MDT)

Medtronic (MDT) Surpasses Q1 Earnings and Revenue Estimates

Medtronic (MDT) came out with quarterly earnings of $1.23 per share, beating the Zacks Consensus Estimate of $1.20 per share. This compares to earnings of $1.20 per share a year ago.

Medtronic lifts profit forecast on medical devices demand, new launches

Medtronic slightly lifted the lower end of its annual profit forecast on Tuesday, banking on sustained demand for its medical devices and growth from its new launches.

Medtronic's stock gains after profit and sales topped forecasts, and the full-year outlook was nudged up

Shares of Medtronic PLC MDT, +0.26% gained 0.8% in premarket trading Tuesday, after the cardiovascular and medical surgical products company topped fiscal first-quarter profit and sales expectations and nudged up its full-year outlook. Net income for the quarter to July 26 rose to $1.04 billion, or 80 cents a share, from $791 million, or 59 cents a share, in the year-ago period.

Should You Buy, Sell or Hold Medtronic (MDT) Before Q1 Earnings?

Medtronic's (MDT) first-quarter profits might have been dented by higher costs and expenses originating from macro issues and geopolitical complexities. However, innovations may have boosted the top line.

Medtronic: Healthy Vital Signs Heading Into Earnings

Medtronic stock underperformed the market, up only 4% in the past year. The options market predicts a 3.3% stock price swing post-earnings. Mid-single-digit EPS growth, rising dividends, and historically high yield for Medtronic are positive factors.

Medtronic: Still A Buy Before Earnings

Medtronic is a strong option for investors seeking both low volatility and consistent dividend growth. I am quite positive about recent developments related to new crucial FDA approvals. Various valuation approaches suggest that the current share price is attractive.

Is An Earnings Beat In The Cards For Medtronic Stock?

Medtronic (NYSE: MDT) is scheduled to report its fiscal 2025 first-quarter results on Tuesday, August 20 (fiscal year ends in April). We expect Medtronic stock to trade higher post-Q1 results announcement, with its revenues and earnings expected to be slightly above the street estimates.

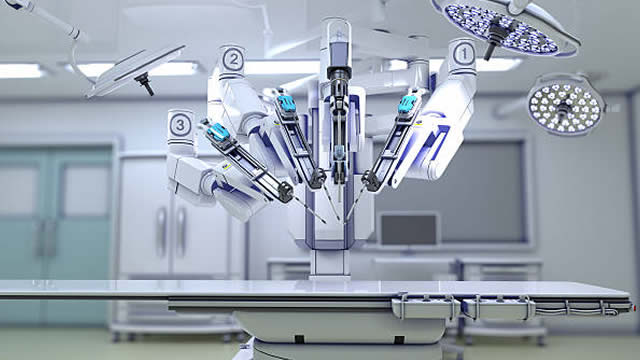

Medtronic (MDT) Progresses in CGM With New Approval, Alliance

The FDA approval for Medtronic's (MDT) Simplera CGM sets the stage for further regulatory submissions of the updated InPen smart insulin pen app.

Seeking Clues to Medtronic (MDT) Q1 Earnings? A Peek Into Wall Street Projections for Key Metrics

Get a deeper insight into the potential performance of Medtronic (MDT) for the quarter ended July 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Medtronic (MDT) Increases Yet Falls Behind Market: What Investors Need to Know

In the closing of the recent trading day, Medtronic (MDT) stood at $82.27, denoting a +1.33% change from the preceding trading day.

Medtronic (MDT) Rises Yet Lags Behind Market: Some Facts Worth Knowing

The latest trading day saw Medtronic (MDT) settling at $80.78, representing a +0.56% change from its previous close.

2 Dividend Stocks to Buy and Never Sell

Merck is finding ways to avoid a fast-approaching patent cliff by continuing to do what it's done for a while. Medtronic is a diversified healthcare giant with several important long-term growth catalysts.