3M Company (MMM)

3M Gears Up to Report Q3 Earnings: Is a Beat in the Offing?

MMM readies its Q3 results with steady gains in key segments and a positive earnings signal hinting at another potential beat.

3M's Restructuring Delivers Richer Margins And Renewed Growth Opportunities

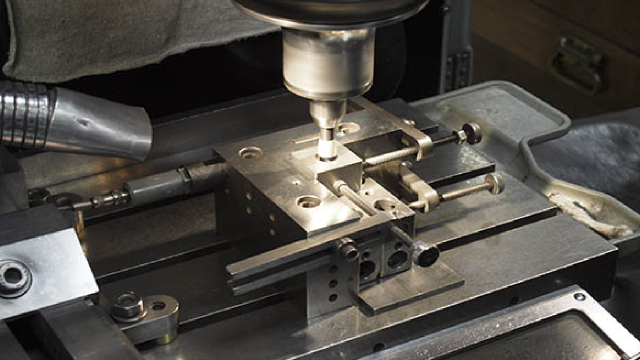

MMM's ongoing renewal of its aging portfolio delivers accelerated growth prospects beyond historical levels, with the new product launches expected to deliver +15% YoY sales growth in FY2025. This is on top of the streamlined operations, expansion of its machine utilization, increased sales effectiveness, and improved pricing power, with it triggering the raised FY2025 guidance. The raised FY2025 Free Cash Flow guidance also lent strength to MMM's secure dividend investment thesis and ongoing share retirement cadence.

Why Dividend Cuts Aren't Always Bad: A Case Study From 3M

Few things are more misleading than a blue-chip company under financial strain that keeps paying, and sometimes even raising its dividend. On the surface, it signals confidence. Underneath, it can mask deteriorating fundamentals. But just as cutting losses can be a healthy decision in investing, the same principle applies to companies reassessing their dividend strategy.

3M's Margins Expand Despite Rising Costs: Can the Momentum Sustain?

MMM posts higher Q2 earnings and margin gains despite rising costs, lifting its 2025 EPS outlook on productivity and reorganization efforts.

3M Company Rises 22.3% YTD: Should You Buy the Stock Now or Wait?

MMM stock is up 22.3% YTD, driven by strong segment growth and cost actions, but high debt and valuation weigh on near-term upside.

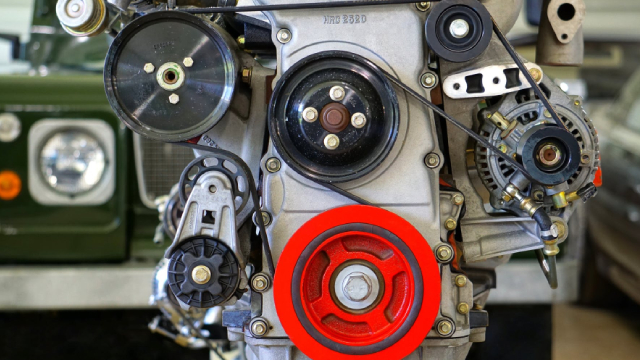

3M's Transportation and Electronics Revenues Up in Q2: Can Momentum Last?

MMM's Transportation and Electronics unit posts 1% revenue growth in Q2 2025, fueled by aerospace and electronics gains despite market headwinds.

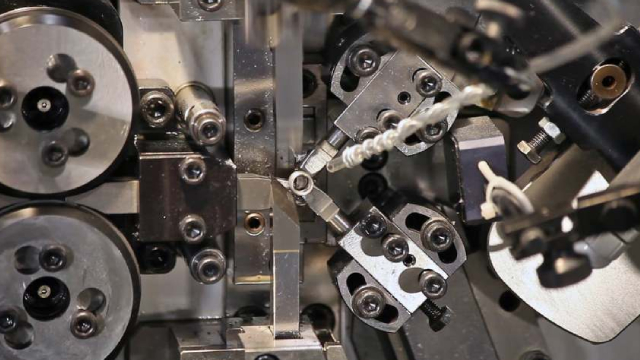

3M's Safety & Industrial Revenues Accelerate: More Upside to Come?

MMM's Safety and Industrial unit posts fifth straight quarter of growth, fueled by demand in safety and electrical markets.

3M: A Reliable American Giant

3M's strong Q2 2025 results show robust sales, expanding margins, and impressive free cash flow conversion, supporting continued shareholder returns. The company has largely resolved major lawsuits, reducing legal overhang and positioning itself for future growth and stability. 3M's diversified business segments, especially safety and industrial, continue to deliver high margins and growth despite some weakness in consumer and electronics.

3M: Time To Close Your Position (Rating Downgrade)

3M's sales remain flat, with no signs of a true turnaround, despite some resilience across business divisions and modest organic growth. Profitability has improved, but inventory and receivables increases raise concern about demand and cash flow, respectively. Full-year guidance indicates continued sluggish sales, and a slowdown in EPS and margin growth, while tariff headwinds are less severe than feared.

3M's Raised FY2025 Guidance Signals Promising Fundamentals

3M's correction after the double-beat FQ2'25 performance and the raised FY2025 adj EPS guidance implies a notable profit taking at recent heights. This is worsened by the uncertainties arising from the mixed macroeconomic environment, the ongoing tariff war, and the softer auto/consumer electronics end market. Even so, we believe that MMM remains highly compelling, as the management aims to drive renewed growth through strategic product launches in the semiconductor/aerospace end market.

3M Company (MMM) Q2 2025 Earnings Call Transcript

3M Company (NYSE:MMM ) Q2 2025 Earnings Conference Call July 18, 2025 9:00 AM ET Company Participants Anurag Maheshwari - CFO & Executive VP Chinmay Trivedi - Senior Vice President of Investor Relations and Financial Planning & Analysis William M. Brown - CEO & Chairman Conference Call Participants Amit Singh Mehrotra - UBS Investment Bank, Research Division Andrew Alec Kaplowitz - Citigroup Inc., Research Division Andrew Burris Obin - BofA Securities, Research Division Charles Stephen Tusa - JPMorgan Chase & Co, Research Division Christopher M.

3M's Earnings & Revenues Surpass Estimates in Q2, Increase Y/Y

MMM tops Q2 estimates with 12% EPS growth and raises its 2025 outlook, supported by strength in Safety and Industrial.