Moderna, Inc. (MRNA)

Moderna Q4 Loss Narrower-Than-Expected, Sales Beat Estimates

MRNA posts a narrower Q4 loss and beats sales estimates, despite a 30% revenue drop, while advancing its pipeline and reaffirming 2026 outlook.

Moderna shares pop on strong guidance, smaller-than-expected loss

Moderna Inc (NASDAQ:MRNA, XETRA:0QF) reported fourth quarter 2025 results that exceeded Wall Street expectations, sending its shares up about 11% on Friday. The company posted a net loss of $2.11 per share on revenue of $678 million, compared with analysts' consensus of a $2.60 loss on revenue near $660 million.

Moderna (MRNA) Reports Q4 Loss, Beats Revenue Estimates

Moderna (MRNA) came out with a quarterly loss of $2.11 per share versus the Zacks Consensus Estimate of a loss of $2.6. This compares to a loss of $2.5 per share a year ago.

Moderna Just Crushed Estimates While Everyone Was Looking the Other Way

Moderna (NASDAQ: MRNA) reported fourth-quarter results Friday morning that beat Wall Street's muted expectations, delivering revenue of $678 million against estimates of $663 million and a loss of $2.11 per share compared to the expected loss of $2.64.

Moderna Narrows Loss, Reiterates 10% Revenue Growth Target

Moderna said it continues to target 10% revenue growth this year, as the company's fourth-quarter loss narrowed from a year earlier.

Moderna beats fourth-quarter revenue estimates

Moderna reported fourth-quarter revenue above Wall Street estimates on Friday, banking on better-than-expected sales of its COVID-19 vaccine in the U.S.

Biotech Turnaround: How Moderna Went From Revenue Collapse to YTD Rally Leader

Moderna Inc (NASDAQ:MRNA) has delivered a 37% gain year-to-date, dramatically outpacing the biotech sector's 0.4% YTD return.

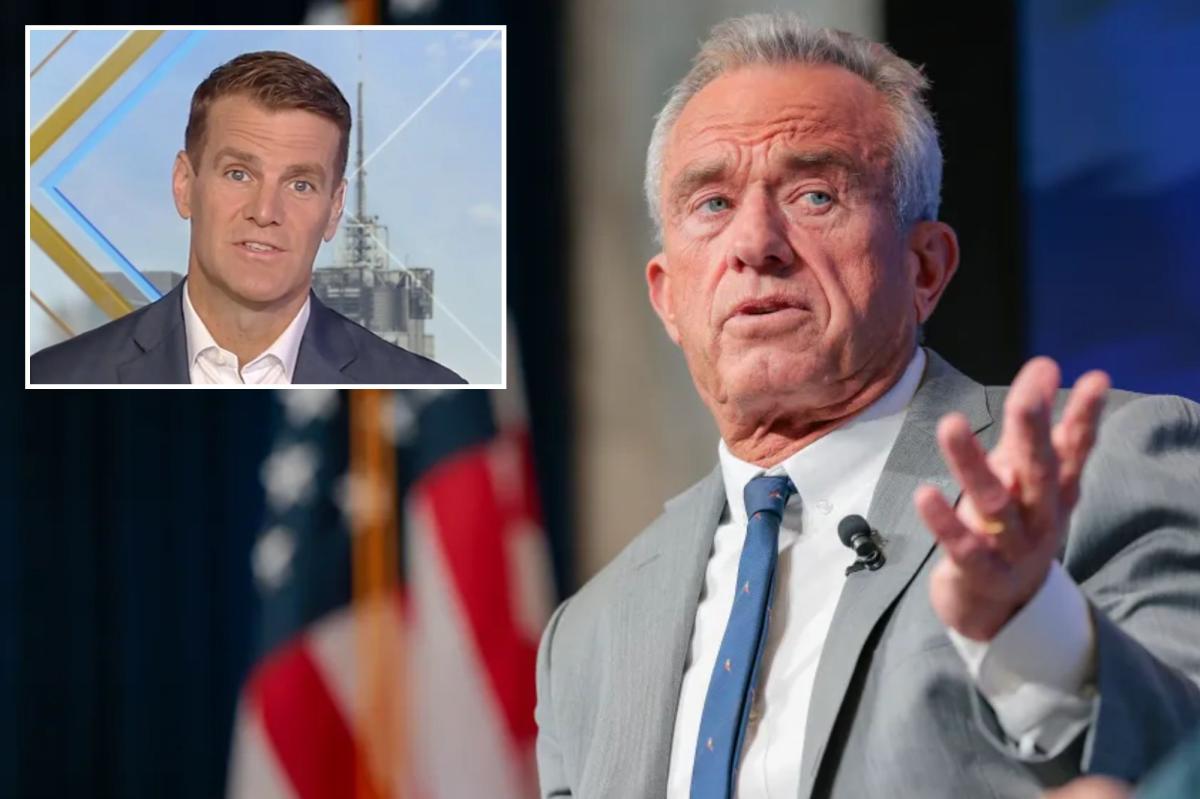

Why is the FDA refusing Moderna's application for a new mRNA flu vaccine?

The U.S. Food and Drug Administration is refusing to consider Moderna's application for a new flu vaccine made with Nobel Prize-winning mRNA technology, the company announced Tuesday.The news is the latest sign of the FDA's heightened scrutiny of vaccines under Health Secretary Robert F. Kennedy Jr., particularly those using mRNA technology, which he has criticized before and after becoming the nation's top health official.Moderna received what's called a “refusal-to-file” letter from the FDA that objected to how it conducted a 40,000-person clinical trial comparing its new vaccine to one of the standard flu shots used today.

The FDA's refusal to review Moderna's application to sell a new flu shot is part of a pattern of regulatory U-turns and overruling of FDA staff by Vinay Prasad, head of the agency's vaccine division

The head of the agency's vaccine division, Vinay Prasad, has overruled pushback from career staffers.

FDA blindsides Moderna with refusal to review flu vaccine application: ‘We're pretty confused'

The new shot was not compared to “the best-available standard of care in the United States at the time of the study,” an FDA official told Moderna.

Moderna's investigational flu vaccine denied FDA review, shares drop

Moderna Inc (NASDAQ:MRNA, XETRA:0QF) shares fell almost 6% after the drugmaker announced that the US Food and Drug Administration's (FDA) Center for Biologics Evaluation and Research (CBER) has issued a Refusal-to-File (RTF) letter for the company's biologics license application for its investigational seasonal influenza vaccine, mRNA-1010. According to the company, the FDA cited the choice of a licensed standard-dose influenza vaccine as the comparator in Moderna's Phase 3 trial as the reason for the refusal.

MRNA Down Nearly 10% as FDA Refuses to Review Influenza Vaccine BLA

Moderna shares sink 10% after FDA issues Refusal-to-File letter for its mRNA-1010 flu vaccine, citing trial design concerns despite no safety flags.