Marvell Technology, Inc. (MRVL)

Investors Heavily Search Marvell Technology, Inc. (MRVL): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Marvell (MRVL). This makes it worthwhile to examine what the stock has in store.

Marvell Technology Jumps 70% in Six Months: Is the Stock Still a Buy?

MRVL's AI-driven growth and robust financials make it a must-buy stock poised for continued success in the near term.

Is It Worth Investing in Marvell (MRVL) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

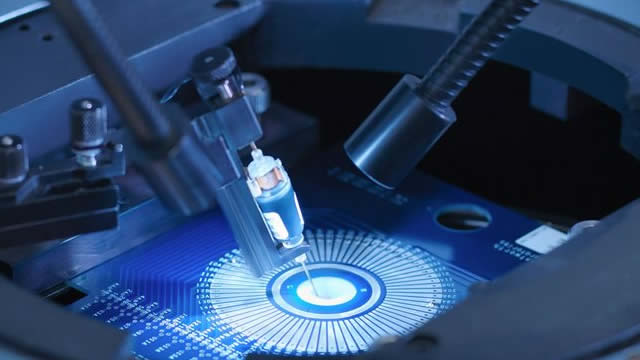

Marvell Technologies: A High-Risk, High-Reward Investment Opportunity In The AI Infrastructure Market

Marvell Technology's collaboration with Amazon's AWS on Trainium chips boosts its AI infrastructure potential, making it an interesting investment consideration despite high valuation concerns. The company's third-quarter FY 2025 data center revenue increased 98% year-over-year, highlighting strong AI market demand. Despite restructuring charges impacting GAAP profitability, its non-GAAP EPS beat estimates, showing significant business model leverage and potential for future profitability.

Marvell Technology (MRVL) Beats Stock Market Upswing: What Investors Need to Know

In the latest trading session, Marvell Technology (MRVL) closed at $112.80, marking a +1.97% move from the previous day.

Why Marvell (MRVL) is Poised to Beat Earnings Estimates Again

Marvell (MRVL) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Why Investors Need to Take Advantage of These 2 Computer and Technology Stocks Now

Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

Marvell Technology (MRVL) Advances While Market Declines: Some Information for Investors

Marvell Technology (MRVL) closed at $113.56 in the latest trading session, marking a +0.62% move from the prior day.

Here is What to Know Beyond Why Marvell Technology, Inc. (MRVL) is a Trending Stock

Marvell (MRVL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Marvell Technology (MRVL) is a Great Momentum Stock: Should You Buy?

Does Marvell Technology (MRVL) have what it takes to be a top stock pick for momentum investors? Let's find out.

Is Marvell (MRVL) a Buy as Wall Street Analysts Look Optimistic?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Marvell Technology (MRVL) Stock Dips While Market Gains: Key Facts

Marvell Technology (MRVL) closed the most recent trading day at $123.75, moving -0.81% from the previous trading session.