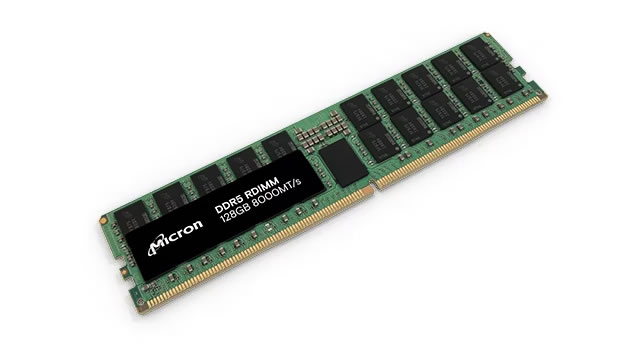

Micron Technology, Inc. (MU)

Prediction: This AI Stock Will Beat the Market In 2025

In today's video, I discuss Micron Technology (MU -1.00%), its business strategy, growth opportunities, potential risks, and why investors should not ignore this AI stock.

Is Micron Technology Stock Going to $163? 1 Wall Street Analyst Thinks So.

Micron Technology (MU -2.06%) recently reported another quarter of strong demand for its memory products. Baird analyst Tristan Gerra updated his guidance as a result, maintaining an outperform (buy) rating on the shares and changing the firm's price target from $130 to $163.

Micron Investors Should 'Keep The Main Thing The Main Thing'

Self-help authors tell people to “keep the main thing the main thing.

Micron: How I Trade Cyclical Stocks

Investors might be tempted to do some bottom fishing with Micron Technology, Inc.'s stock's recent price dip. The current low P/E adds further alure. However, I want to remind investors that P/E is a horrible leading indicator for cyclical stocks like MU.

Micron: Not A Trojan Horse, Eyeing +$100 - Reiterating Buy

Micron Technology, Inc. sold off post-2Q25 earnings on gross margin concerns; Wall Street's panic selling is a buying opportunity. DRAM and NAND price increases, with spot prices already going north week to week, should reverse margin panic into 2H25. DRAM sales, amounting to ~76% of total sales this quarter, should also grow with content growth in AI server and PC recovery.

Looking for a Bargain? 1 Artificial Intelligence (AI) Chip Stock to Buy the Dip Hand Over Fist.

This year has been absolutely brutal for technology stocks so far. In particular, the semiconductor industry has witnessed some notable sell-offs.

The Market Is Wrong: 3 Reasons Micron's Stock Should Be Up, Not Down After Earnings

Shares of memory giant Micron (MU 2.32%) fell more than 8% last Friday following its late Thursday earnings release.

Micron Plunges 8% on Sinking Margins: Time to Sell the Stock?

The sequential decline in profitability, coupled with pricing pressures and bearish technical indicators, make MU stock a risky bet at current levels.

Micron Technology, Inc. (MU) is Attracting Investor Attention: Here is What You Should Know

Micron (MU) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Micron: This Dip Looks Like A Gift

Micron's Q2 FY 2025 results exceeded expectations, with strong revenue growth and profitability, driven by high demand in the data center and automotive sectors. Despite initial positive market reaction, profit-taking led to an 8% drop in share price, presenting a buying opportunity, given Micron's strong fundamentals. Micron's Q3 FY 2025 outlook shows continued revenue growth, but margin pressures due to a strategic shift toward lower-margin products and underutilized NAND capacity.

Should Investors Buy Micron Stock Right Now?

Micron Technology (MU -8.03%) reported what I thought were solid earnings, and its stock price is still falling the day after it announced the figures.

Micron Q2: AI Agents Accelerating Growth

Micron Technology, Inc.'s strong AI-driven demand, especially in data center DRAM and HBM, positions it for significant growth despite recent stock volatility. Q2 results showed a 38% YoY revenue jump, with DRAM revenue up 47%, highlighting robust fundamentals and market leadership. Despite short-term concerns in NAND flash, Micron's AI and data center momentum suggests a long-term growth trajectory, making shares a strong buy.