Newmont Corporation (NEM)

Newmont: The Show Must Go On

The outlook remains bullish as Newmont capitalizes on record gold prices and robust demand amid ongoing global uncertainty. Q2 earnings beat expectations with strong revenue and EPS growth, driven by high gold prices and disciplined cost management. Valuation remains attractive, with forward P/E ratios well below sector averages and consensus price targets offering solid upside.

Newmont Corporation (NEM) Q2 2025 Earnings Call Transcript

Newmont Corporation (NYSE:NEM ) Q2 2025 Earnings Conference Call July 24, 2025 5:30 PM ET Company Participants Natascha Viljoen - President & COO Thomas Ronald Palmer - CEO & Director Conference Call Participants Anita Soni - CIBC Capital Markets, Research Division Daniel Morgan - Barrenjoey Markets Pty Limited, Research Division Daniel Edward Major - UBS Investment Bank, Research Division Fahad Tariq - Jefferies LLC, Research Division Hugo Nicolaci - Goldman Sachs Group, Inc., Research Division Joshua Mark Wolfson - RBC Capital Markets, Research Division Lawson Winder - BofA Securities, Research Division Matthew Murphy - BMO Capital Markets Equity Research Tanya M. Jakusconek - Scotiabank Global Banking and Markets, Research Division Operator Hello, and welcome to Newmont's Second Quarter 2025 Earnings Conference Call.

Compared to Estimates, Newmont (NEM) Q2 Earnings: A Look at Key Metrics

The headline numbers for Newmont (NEM) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Newmont Corporation (NEM) Tops Q2 Earnings and Revenue Estimates

Newmont Corporation (NEM) came out with quarterly earnings of $1.43 per share, beating the Zacks Consensus Estimate of $1.04 per share. This compares to earnings of $0.72 per share a year ago.

Newmont reports record free cash flow in Q2 despite lower production

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

Barrick Mining vs. Newmont: Which Gold Giant Is the Better Bet Now?

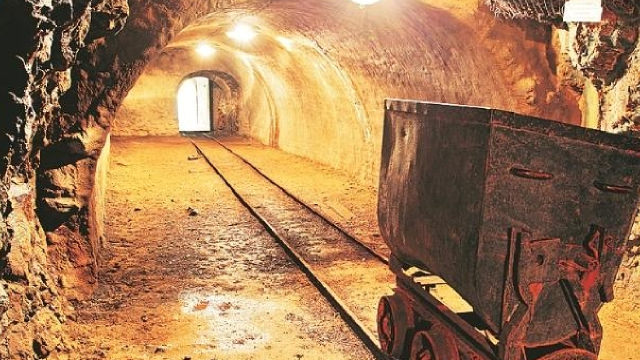

Barrick and Newmont ramp up growth projects as elevated gold prices reshape the mining investment landscape.

Here's Why Newmont Corporation (NEM) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Should You Buy Newmont Stock Ahead of Q2 Earnings Report?

NEM is expected to have benefited from higher gold prices amid cost headwinds in the second quarter.

Seeking Clues to Newmont (NEM) Q2 Earnings? A Peek Into Wall Street Projections for Key Metrics

Evaluate the expected performance of Newmont (NEM) for the quarter ended June 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Here's Why Newmont Corporation (NEM) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

What To Expect From Newmont's Q2?

Newmont (NYSE:NEM) is scheduled to announce its earnings on Thursday, July 24, 2025. The consensus estimate for earnings is approximately $1.01 per share, while revenues are projected to increase by nearly 9% compared to the same quarter last year, thanks to higher average gold prices.

Here is What to Know Beyond Why Newmont Corporation (NEM) is a Trending Stock

Newmont (NEM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.