Newmont Corporation (NEM)

Newmont Corporation (NEM) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, Newmont Corporation (NEM) closed at $59.46, indicating a +2.11% shift from the previous trading day.

Newmont (NEM) Upgraded to Strong Buy: Here's Why

Newmont (NEM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

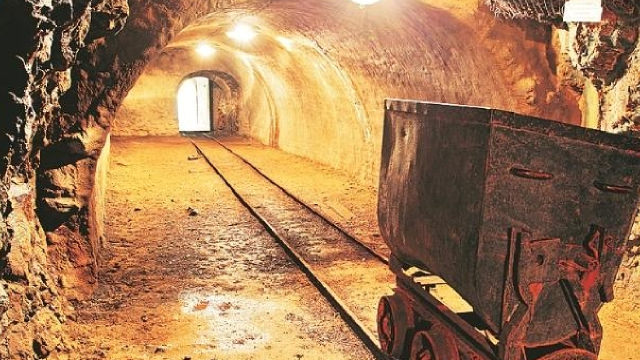

5 Gold Mining Stocks to Buy as Industry Prospects Look Bright

With rising gold prices and solid demand boding well for the Zacks Mining - Gold industry, investors may scoop up stocks like NEM, FNV, KGC, EGO and NGD.

Newmont Gains 22% in 3 Months: How Should Investors Play the Stock?

NEM climbs 22% in 3 months, fueled by gold's surge on strong safe-haven demand and rising earnings estimates.

NEM's Gold Output Hit by Divestments: Can Tier-1 Assets Close the Gap?

NEM's gold production dropped in Q1 as it exited non-core assets, with Tier-1 mines now facing pressure to deliver.

Here's Why Newmont Corporation (NEM) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Newmont Corporation (NEM) Recently Broke Out Above the 20-Day Moving Average

Newmont Corporation (NEM) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, NEM broke through the 20-day moving average, which suggests a short-term bullish trend.

Newmont's Soaring Unit Costs Warrant Caution: Can It Protect Margins?

NEM's Q1 cost surge and projected AISC rise raise concerns over profitability despite gold price-driven stock gains.

Newmont Corporation (NEM) Stock Falls Amid Market Uptick: What Investors Need to Know

Newmont Corporation (NEM) closed at $52.56 in the latest trading session, marking a -1.35% move from the prior day.

Newmont: Even Conservative Earnings Estimates Indicate Upside

Newmont's price might not have gone anywhere in the past couple of months, but there's a good reason it can, even after the stock's robust YTD gains. Gold price, for one, is firmly on the upward trajectory after a small wobble following hopes of improved economic prospects because of US-China talks. The company's Q1 2025 earnings also surprised significantly to the upside, leaving room for more of the same trend for the rest of 2025.

Are Basic Materials Stocks Lagging Newmont (NEM) This Year?

Here is how Newmont Corporation (NEM) and Posco (PKX) have performed compared to their sector so far this year.