Newmont Corporation (NEM)

VIX Vixens: 7 Attractive Stock Bets as the Fear Gauge Spikes

Early this month, the CBOE Volatility Index, or VIX soared to multi-year highs. As a contrarian indicator, a northward trek of the fear gauge implies a negative outlook for equities.

Why Newmont Corporation (NEM) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

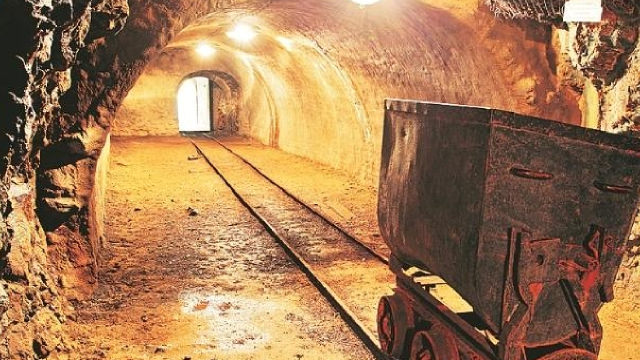

Newmont's (NEM) 5G Trial at Cadia Mine Shows Strong Results

Newmont (NEM) demonstrates the potential to reach upload rates of about 90 Mbps along access drives and declines throughout the underground complex.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Newmont (NEM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

This Top Basic Materials Stock is a #1 (Strong Buy): Why It Should Be on Your Radar

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Rank.

Newmont (NEM) Rallies 42% in 6 Months: Is it a Good Time to Buy?

With a robust portfolio of growth projects, solid financial health and a healthy growth trajectory, Newmont (NEM) presents a compelling investment case for those looking to capitalize on favorable gold market conditions.

Brokers Suggest Investing in Newmont (NEM): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Newmont Stock: Stake a Claim in the World's Largest Gold Miner

Newmont Co. NYSE: NEM is the world's largest gold mining company. The company engages in the exploration, development, and production of not only gold but also copper, silvers, zinc, lead, lithium, coal, nickel, and aggregates.

Top 2 Materials Stocks That May Crash In Q3

As of Aug 2, 2024, two stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

Earnings Estimates Moving Higher for Newmont (NEM): Time to Buy?

Newmont (NEM) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Newmont Corporation (NEM) Just Overtook the 20-Day Moving Average

Newmont Corporation (NEM) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, NEM broke through the 20-day moving average, which suggests a short-term bullish trend.

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.