Newmont Corporation (NEM)

Western Digital, Newmont, and 5 Star Stocks That Survived the AI Selloff and Have More to Give.

Investors will be weighing up how to shield their portfolios in case the rebound loses steam. These stocks look tempting.

Newmont Corporation (NEM) Crossed Above the 20-Day Moving Average: What That Means for Investors

Newmont Corporation (NEM) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, NEM broke through the 20-day moving average, which suggests a short-term bullish trend.

Newmont Corporation (NEM) Recently Broke Out Above the 50-Day Moving Average

Newmont Corporation (NEM) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, NEM broke through the 50-day moving average, which suggests a short-term bullish trend.

This Top Basic Materials Stock is a #1 (Strong Buy): Why It Should Be on Your Radar

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Rank.

3 Reasons Growth Investors Will Love Newmont (NEM)

Newmont (NEM) possesses solid growth attributes, which could help it handily outperform the market.

All You Need to Know About Newmont (NEM) Rating Upgrade to Buy

Newmont (NEM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

NEM or AEM: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Mining - Gold sector might want to consider either Newmont Corporation (NEM) or Agnico Eagle Mines (AEM). But which of these two companies is the best option for those looking for undervalued stocks?

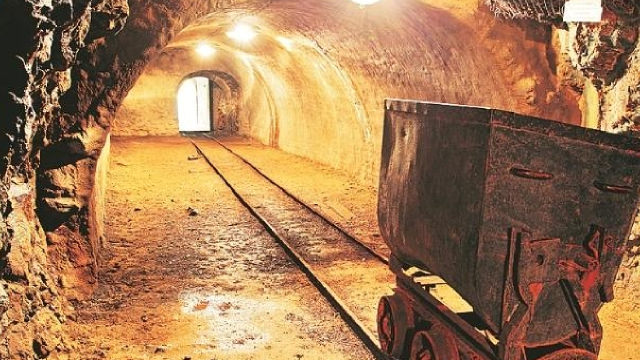

Can Newmont's Tier-1 Pivot Stem Its Ongoing Production Declines?

NEM's third-quarter gold output slid again as its Tier-1 pivot reshapes production and tests its 2025 outlook.

NEM vs. AEM: Which Gold Mining Stock Should You Invest in Now?

Newmont and Agnico Eagle strengthen their positions with rising cash flows, project expansions, and steady dividends amid firm gold prices.

Here's Why Newmont Corporation (NEM) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why Newmont Corporation (NEM) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Newmont (NEM). This makes it worthwhile to examine what the stock has in store.