Netflix, Inc. (NFLX)

Netflix is Set to Report Earnings Today. Hits Like 'KPop Demon Hunters' Likely Drove Strong Results

Can Netflix keep up its recent momentum and maintain its reputation as a streaming winner?

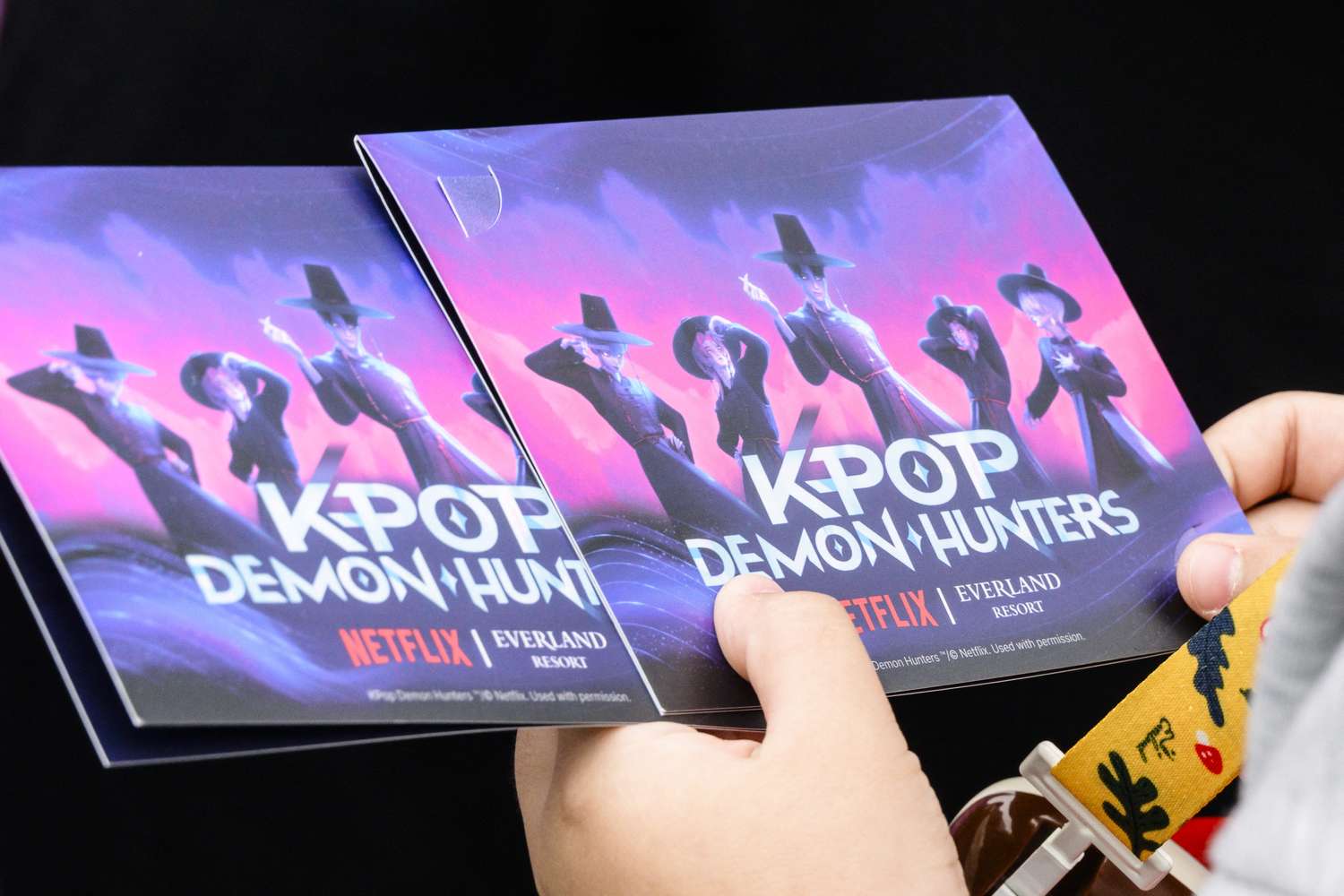

Netflix strikes 'KPop Demon Hunters' toy deals with both Mattel and Hasbro

Netflix has signed on Mattel and Hasbro to make toys and consumer products based off "KPop Demon Hunters." Mattel will handle dolls, action figures, accessories and playsets, while Hasbro will focus on plush, electronics, roleplay items and board games.

Earnings Preview: What To Expect From Netflix Results

Netflix Inc. Inc. scheduled to report earnings after Tuesday's close. The stock hit a record high of $1,341/share in June 2025 and, as of this writing, it is currently trading near $1,240.

Netflix Earnings Preview: Expectations Rather 'Meh' Pre-Earnings Likely A Good Thing

The stock has traded in a narrow range the last few months, gyrating around its 50-day moving average at $1,214. Analysts are expecting Netflix to earn $6.96 in earnings per share on $11.52 billion in revenue, for expected y-o-y growth of 29% and 17%, respectively. Closing at $1,238 today, Monday, October 20, 2025, Netflix is trading at 47x earnings for expected EPS growth of 33% in 2025, so the stock is somewhat cheaper vs its expected '25 EPS growth rate.

Big Money Exits: Wealth Advisor Slices Well-Known Streaming Stock, Recent Filing Reveals

Sapient Capital reduced its Netflix (NFLX 1.40%)stake by selling 2,804 shares for an estimated $3.42 million in Q3 2025, according to an SEC filing dated October 17, 2025.

Can Netflix Shares Hit New Record Highs?

Beyond its core subscription and advertising business, Netflix is expanding into new forms of digital entertainment.

Netflix Earnings Preview: Q3 2025

In the previous three-month period, Netflix provided guidance for a stable outlook, in line with consensus. NFLX expects to grow revenue by increasing engagement trends and reducing churn while offering more diverse entertainment products. Netflix remains upbeat about the long-term opportunity, given the size of its user base.

Netflix Gears Up to Report Q3 Earnings: Buy, Sell or Hold NFLX Stock?

NFLX's Q3 guidance signals steady growth, yet premium valuation and competition suggest holding or awaiting better entry opportunities before quarterly results.

Netflix poised for strong holiday quarter on subscriber and ad revenue growth: analysts

Netflix Inc (NASDAQ:NFLX, ETR:NFC) continues to have Wedbush analysts bullish, with the firm repeating its ‘Outperform' rating and 12-month price target of $1,500 on the streaming giant, citing steady subscriber growth, growing ad revenue, and strong upcoming content. Shares of Netflix are up 35% in the year to date, trading hands at about $1,211 on Wednesday.

Spotify video podcasts head to Netflix under new distribution tie-up

Netflix said on Tuesday it will add a slate of Spotify's most popular video podcasts to its service from early 2026, part of a new distribution partnership aimed at broadening the streaming giant's entertainment lineup and drawing new audiences.

Spotify partners with Netflix for video podcast distribution deal

Spotify is bringing its video podcasts to Netflix starting next year, the company announced on Tuesday. Amid the company's push to further expand its video content selection and boost its ads business, Spotify has announced a partnership with Netflix that will showcase select video podcasts on the popular streaming service.

Netflix vs. Amazon: Which Streaming Giant Has Better Upside Potential?

NFLX trades at 39.39x earnings with strong profitability, but AMZN's 29.43x multiple spans AWS, advertising, and e-commerce, offering diversified upside potential.