NVIDIA Corporation (NVDA)

NVIDIA (NASDAQ: NVDA) Price Prediction and Forecast 2026-2030 for January 13

Shares of NVIDIA Corp. (NASDAQ:NVDA) lost 2.91% over the past five trading sessions after gaining 0.24% the five prior.

NVIDIA Corporation (NVDA) Presents at 44th Annual J.P. Morgan Healthcare Conference Transcript

NVIDIA Corporation (NVDA) Presents at 44th Annual J.P. Morgan Healthcare Conference Transcript

This NVIDIA Partnership Shows How Big AI Can Really Get

NVIDIA's NASDAQ: NVDA market is heating up, approaching the boiling point once again, as its long-term outlook swells and the valuation becomes irresistible. Trading at 40x earnings in early 2026, this market fails to price in what is quickly becoming an overly cautious forecast.

NVIDIA Corporation (NVDA) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Nvidia (NVDA) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

NVDA, INTC and AMD Forecast – Microchips Slightly Negative Early on Monday

Microchip stocks pull back in premarket trading as traders try to digest the latest headlines in the DoJ investigation of Jerome Powell, and the job report last week.

Nvidia Stock Could Drop 50% and Still Be Worth More Than Meta

Its $4.5 trillion market cap makes Nvidia Corp. (NASDAQ: NVDA) the most valuable company in the world.

Upgrades: Analysts are Still Bullish on Nvidia (NVDA), Crowdstrike (CRWD) and Oracle (ORCL) Upside

Mizuho rates Nvidia as its top semiconductor pick with a $275 price target.

3 Hidden AI Stocks That Can Become This Year's Superstars

AI chipmakers are still getting most of the attention, but there are a bunch of small AI stocks that are producing substantial gains while most people focus on big names like Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO).

5 AI Stocks That Could Replicate NVIDIA's Decade of Dominance

NVIDIA (NASDAQ:NVDA) has delivered a 23,000% return over the past decade has become the benchmark every tech investor measures against.

2 Ways Nvidia Will Make History in 2026 (Hint: You're Going to Want to Buy Now)

Nvidia should pass Alphabet as the world's most profitable company. Nvidia will cross the $6 trillion market cap threshold in 2026.

Want to Buy Artificial Intelligence (AI) Stocks in 2026? These 2 Companies Could Net You Millions in Retirement.

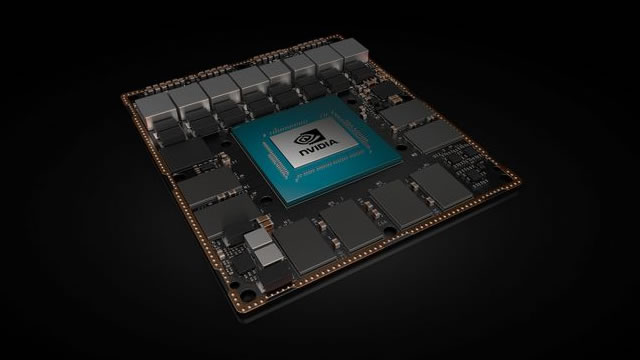

With demand for its Blackwell chips still sky-high, Nvidia has already unveiled its next-generation AI superchip platform. China is a wild card that could add a catalyst for Nvidia stock to jump.

Is Nvidia Stock a Buy for 2026?

Nvidia is valued at about the same level as its peers. Nvidia's new architecture will bring increased spending.