NVIDIA Corporation (NVDA)

Nvidia Unveils Faster AI Chips Sooner Than Expected

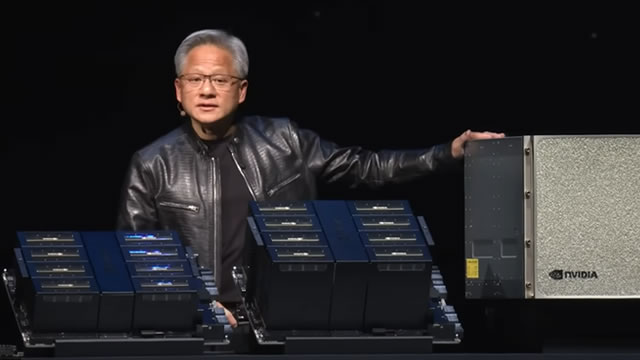

At the Consumer Electronics Show in Las Vegas, CEO Jensen Huang said more powerful chips will enable training of models in simulated environments.

Nvidia CEO Jensen Huang delivers some good news for investors at CES

Nvidia CEO Jensen Huang spent much of his CES speech discussing artificial-intelligence opportunities in self-driving cars and robotics. But roughly an hour into his presentation, investors got what they wanted.

Nvidia CEO Huang Announces New AI Tools for Autonomous Vehicles

Nvidia CEO Jensen Huang announces a group of AI models and tools designed to speed the development of autonomous vehicles during his presentation at the CES trade show in Las Vegas. The free offering is aimed at creating vehicles that can think their way out of unexpected situations, such as a traffic-light outage.

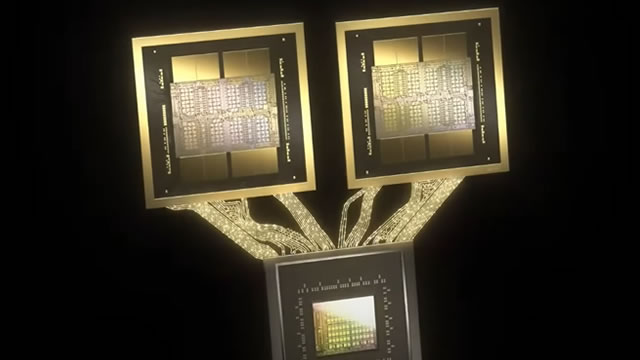

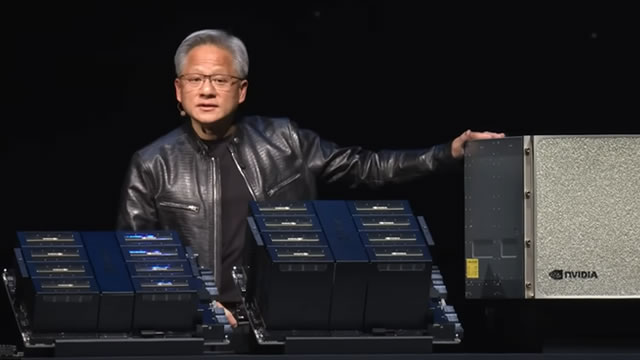

Nvidia launches powerful new Rubin chip architecture

Today at the Consumer Electronics show, Nvidia CEO Jensen Huang officially launched the company's new Rubin computing architecture, which he described as the state of the art in AI hardware. The new architecture is currently in production and is expected to ramp up in the second half of the year.

Nvidia plans to test a robotaxi service in 2027 in self-driving push

Nvidia on Monday unveiled plans to launch a robotaxi service with a partner as soon as 2027, highlighting the chipmaker's ambition to become a major player in the world of self-driving cars. The service would be offered with a partner, and would employ cars with "Level 4" driving, meaning they'd be capable of driving without human intervention in pre-defined regions.

Why chip stocks are extending their gains ahead of Nvidia's CES speech

The semiconductor trade was mostly riding high on Monday as enthusiasm for the artificial-intelligence boom carried into the new year.

Nvidia CEO Huang to take stage at CES in Las Vegas as competition mounts

Nvidia CEO Jensen Huang is set to give a speech on Monday at the Consumer Electronics Show in Las Vegas, potentially revealing new details about product plans for the world's most valuable listed company as it faces increasing competition from both rivals and its own customers.

Is It Worth Investing in Nvidia (NVDA) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

These 3 Stocks Trade at Discounts the Market Won't Ignore Forever

The S&P 500 wrapped up 2025 with a total return of about 18%, the third straight year above historical norms but a lower figure than the gangbusters 25% returns of 2023 and 2024. AI euphoria is still the strongest market trend entering 2026, and the usual suspects like NVIDIA Corp. NASDAQ: NVDA and Alphabet Inc. NASDAQ: GOOGL are up once again on the first day of trading.

Nvidia keynote as focal point for CES as AI shifts towards consumers

CES 2026 in Las Vegas is shaping up to be a pivotal moment for artificial intelligence, according to Wedbush, with the technology-focused investment bank pointing to Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) chief executive Jensen Huang's keynote as the central event of the week. In a note to clients, Wedbush said Nvidia continues to sit at the core of the AI ecosystem and is increasingly viewed as the backbone of the AI revolution.

NVIDIA Soars 39% in 2025: Will the Stock Carry Momentum in 2026?

NVDA rises 38.8% in 2025 as AI-led data center demand drives revenues, earnings and cash flow, supporting a case to stay invested.

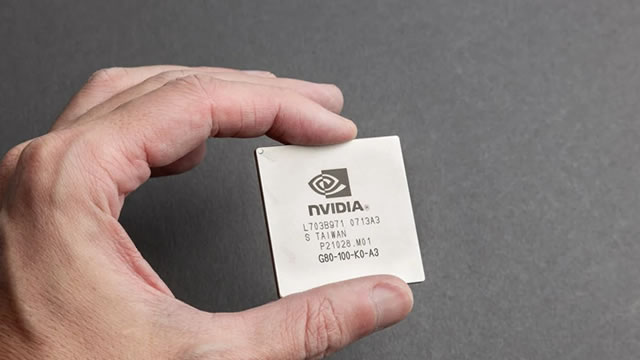

Will NVDA's Blackwell Platform Support Its Data Center Revenue Growth?

NVIDIA's Blackwell architecture boosts data center sales as GB300 systems ship at scale to power complex AI workloads.