NVIDIA Corporation (NVDA)

Nvidia: Implications Of The Groq Deal

Nvidia Corporation announced a landmark $20B acquisition of AI start-up Groq, integrating its LPU technology and engineering talent. This deal directly challenges Google's TPUs, positioning NVDA to dominate both AI training and inference with ultra-low-latency architecture. Integrating Groq's LPUs into the 2026 Vera Rubin chips hedges against high bandwidth memory shortages and strengthens Nvidia's AI ecosystem moat.

If You Invested $10,000 in Nvidia 10 Years Ago, Here's How Much You Would Have Today

Nvidia (NASDAQ:NVDA) has become the face of the artificial intelligence (AI) boom, powering much of the infrastructure behind generative AI and data centers.

Nvidia to acquire Groq talent, assets in reported $20B deal

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) is reportedly acquiring most of the assets of AI chip company Groq in a transaction valued at roughly $20 billion in cash. The deal is also said to include a non-exclusive licensing agreement for Groq's inference technology.

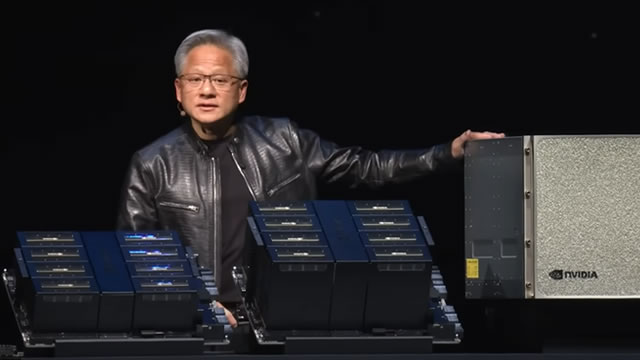

CES sets the tone for a pivotal year in AI

The Consumer Electronics Show in Las Vegas next week will mark the opening act of what Wedbush calls a decisive year for artificial intelligence spending. The broker says the conference will “kick off a key year for the AI revolution”, with the spotlight firmly on Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) and its chief executive Jensen Huang, who delivers the opening keynote on January 5.

Investors Heavily Search NVIDIA Corporation (NVDA): Here is What You Need to Know

Nvidia (NVDA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

NVIDIA Stock Gains on Strategic AI Licensing Deal, Caps a Strong 2025

NVDA rises after a non-exclusive AI licensing deal with Groq, integrating inference tech and leadership, capping a year of strong gains.

Insiders dumped over $1 billion Nvidia shares in 2025

Nvidia (NASDAQ: NVDA) insiders sold more than $1 billion worth of company stock in 2025, cashing in on the chipmaker's sustained rally driven by its advances in artificial intelligence (AI).

Nvidia insists it isn't Enron, but its AI deals are testing investor faith

The chipmaker's sprawling partnerships are driving extraordinary growth but also bank its future on the AI boom paying off quickly

Nvidia's Groq Megadeal; A $20B Inference Pivot To Stay King

NVIDIA solidifies its AI chip leadership by swiftly securing a $20B non-exclusive licensing deal with Groq, a still rising AI chip startup. Integrating Groq's LPUs enhances NVDA's inference capabilities, addressing the industry's rapid shift toward specialized, low-latency AI chips. NVDA leverages its vast free cash flow printing machine and entrenched market dominance to preemptively neutralize emerging threats and reinforce its competitive moat.

2 reasons why Nvidia stock will trade at $300 in 2026

Nvidia's (NASDAQ: NVDA) stock has been among the most closely watched on Wall Street, with investors analyzing both near-term catalysts and longer-range structural shifts in the AI hardware market.

Nvidia strikes Groq deal to bolster inference and ease memory bottlenecks

CNBC's MacKenzie Sigalos reports on Nvidia putting its $60 billion cash pile to work with a Groq licensing-and-talent deal that brings in TPU architect Jonathan Ross and on-chip inference tech.

Nvidia's billion deal with Groq and what it means for the chipmaker and AI

Nvidia (NVDA) reached a deal to license AI chip startup Groq's (GROQ.PVT) technology. Globalt Investments senior portfolio manager Keith Buchanan and Yahoo Finance Senior Reporter Ines Ferré discuss the deal and what it means for Nvidia investors and the broader AI space.