NVIDIA Corporation (NVDA)

Exclusive: Nvidia builds location verification tech that could help fight chip smuggling

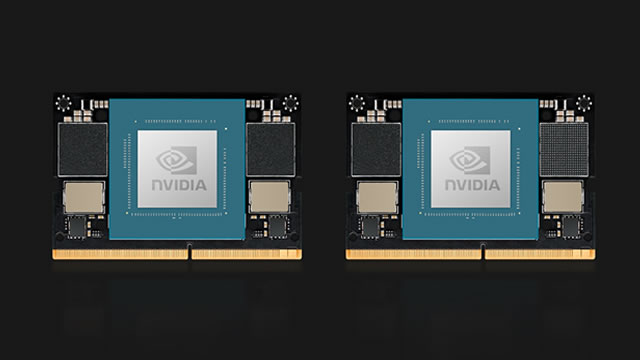

Nvidia has built location verification technology that could indicate which country its chips are operating in, according to sources familiar with the matter, a move that could help prevent its artificial intelligence chips from being smuggled into countries where their export is banned.

'Own it, don't trade it,' says Jim Cramer on Nvidia

CNBC's Jim Cramer talks about the importance of stock picking for individual investors and breaks down what he thinks of Nvidia, Apple and Warner Bros. Discovery.

Trump's Nvidia Chip Deal Reverses Decades of Technology Restrictions

President Trump's decision to allow Nvidia to sell its chips to China has raised questions about whether he is prioritizing short-term economic gain over long-term American security interests.

SoundHound Vs. NVIDIA: Which AI Stock Should You Buy Before 2026?

NVIDIA's surging AI-fueled revenues and profits outshine SoundHound's rising sales, but widening losses as investors look to 2026.

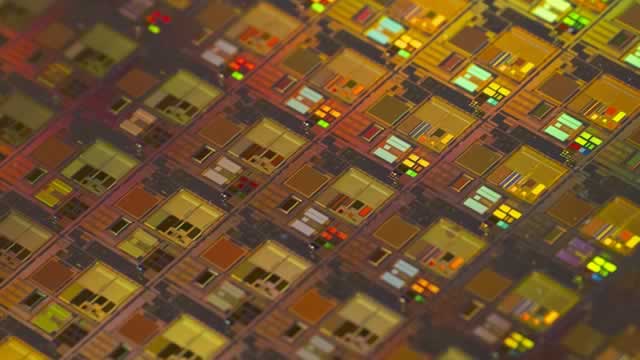

Nvidia could see billions in upside from potential China H200 approval: analysts

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) could unlock more than $5 billion in quarterly revenue as early as 2026 if the US government allows the company to export its H200 artificial intelligence chips to China, UBS said on Monday, after US officials signaled they may approve shipments to certain customers. The US Commerce Department is considering allowing exports of Nvidia's Hopper-generation H200 processors to approved Chinese buyers, although shipments of the newer Blackwell generation remain off the table for now, according to Reuters reporting.

Nvidia AI Chips to Undergo Unusual U.S. Security Review Before Export to China

Shipping chips from Taiwan to U.S. to China would allow government to get 25% cut of sales

Schumer accuses Trump of 'selling out America' after greenlighting Nvidia AI chip exports to China

Sen. Chuck Schumer slammed President Donald Trump's announcement on allowing Nvidia to export its AI chips to China, saying he's "selling out America."

Nvidia Wins Trump's Approval to Sell H200 AI Chips to China, But There's a Catch

Nvidia could be set to sell more of its advanced chips to China, with some conditions.

Nvidia: I'm Going All In Again

Nvidia Corporation remains a compelling long-term investment, with Q3 results exceeding expectations and Q4 guidance raised well above consensus. Hyperscalers' record AI infrastructure spending and robust demand for NVDA's products underpin double-digit growth prospects through at least FY27. My updated DCF model values NVDA at $224.61 per share, reflecting higher revenue growth assumptions and meaningful upside from current levels.

Bank of America Thinks Nvidia Can Charge Toward $275 – What It Sees That the Bears Don't

Bank of America slapped a $275 price target on Nvidia (NASDAQ:NVDA ) stock.

U.S. China hawks say Trump approved Nvidia chip sales to China will supercharge its military

China hardliners in Washington slammed the Trump administration for its decision to allow Nvidia to ship its second most advanced AI chip to China, citing fears Beijing could harness the technology to supercharge its military.

Melius Research's Ben Reitzes: My Nvidia price target is 320 without China

Ben Reitzes, head of technology research at Melius Research, joins CNBC's ‘Squawk on the Street' to discuss Nvidia as the semiconductor giant gets the green light from President Donald Trump to sell its more advanced H200 AI chip to China.