NVIDIA Corporation (NVDA)

Why Nvidia and Other AI Stocks Have Lost Their ‘Quality' Status

A popular ETF dropped Big Tech stocks, which gets at an important issue: Is the bet on artificial intelligence a vast potential profit pool, or a money pit?

What Is One of the Best Tech Stocks to Hold for the Next 10 Years?

The AI chip leader maintains a strong competitive position in providing the essential components to build next-generation data centers. Nvidia offers an attractive valuation relative to its growth prospects.

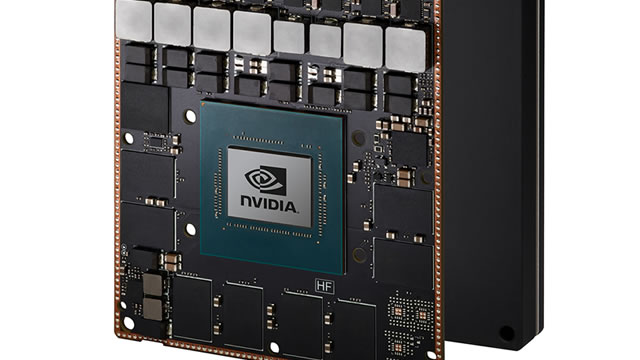

Nvidia vs. Everybody Else: Competition Mounts Against the Top AI Chip Company

Google, Amazon, AMD and Nvidia's own customers are rising to challenge the 800-pound gorilla.

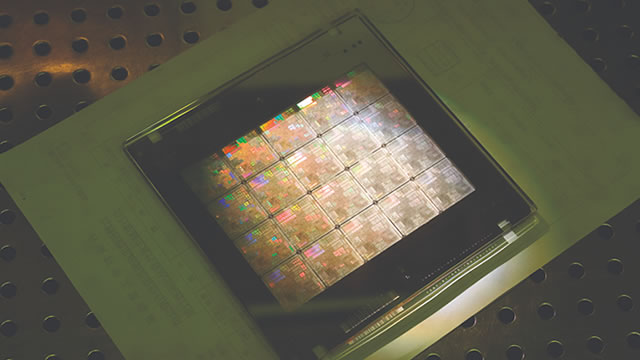

‘China's Nvidia' shows that the global chip race is heating up as it basks in post-IPO glow

Moore Threads Technology's stock rose more than 400% after the AI chip maker's Shanghai IPO on Friday.

Is Trending Stock NVIDIA Corporation (NVDA) a Buy Now?

Nvidia (NVDA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

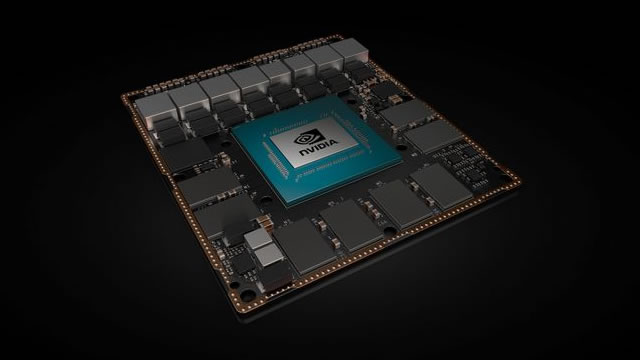

Nvidia: The TPU Risks Look Heavily Overblown

Recent rotation from Nvidia Corporation into Alphabet/Google on TPU enthusiasm created a buyable dip, despite Nvidia still owning the default, general‑purpose AI compute platform across clouds. Nvidia's moat rests on its vertically integrated AI racks—Grace CPUs, Hopper/Blackwell GPUs, Mellanox networking, and CUDA software—rather than raw chip speed, locking in developers and enterprises. TPUs may gain share within Google Cloud, but NVDA's platform remains the industry standard for general-purpose AI workloads.

Nvidia (NASDAQ: NVDA) Bull, Base, & Bear Price Prediction and Forecast (Dec 5)

The trade war with China was tough on Nvidia Corp. (NASDAQ: NVDA) investors.

China Threatens Nvidia With Its Own Company

There has been a long dance between China and the United States over whether Nvidia Corp.

Nvidia's Huang not that comfortable with success, says author

This year's FT and Schroders Business Book of the Year has been awarded to Stephen Witt's "The Thinking Machine: Jensen Huang, Nvidia, and the World's Most Coveted Microchip", for its unprecedented access and insight into the making of one of the most consequential CEOs and companies of our time.

China's Nvidia-like Moore Threads set for trading debut after $1.1 billion IPO

Moore Threads Technology Co , dubbed by analysts as "China's Nvidia", is expected to make a strong market debut in Shanghai on Friday, on bets that the U.S.-blacklisted startup will benefit from Beijing's drive to boost domestic chip manufacturing.

NVDA "Rising Tide," AVGO Accelerating Demand, GOOGL & AMZN Power Competition

Jed Ellerbroek says the A.I. trade has turned "skittish" but the overall market strength remains intact.

2 companies to hit $5 trillion market cap in 2026

Nvidia (NASDAQ: NVDA) and Apple (NASDAQ: AAPL) are emerging as the two strongest candidates to reach, or in Nvidia's case revisit, a $5 trillion market capitalization in 2026, according to the latest market data and analyst forecasts reviewed by Finbold.