New York Times Co. (NYT)

New York Times Stock Drops. Pre-Election Strike Overshadows Solid Earnings.

Operating profit at the newspaper publisher rises 16% and subscribers grow to more than 11 million for the first time.

New York Times (NYT) Reports Q3 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for New York Times (NYT) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

NY Times Sees Digital Subscriptions Slow as Consumers Cut Spending

The New York Times has reportedly seen digital subscriptions slow amid weakened consumer spending. The media company added 260,000 digital-only subscribers during its third quarter, down from 300,000 in the prior quarter, Reuters reported Monday (Nov. 4).

The New York Times Company (NYT) Q3 2024 Earnings Call Transcript

The New York Times Company (NYSE:NYT ) Q3 2024 Earnings Conference Call November 4, 2024 8:00 AM ET Company Participants Anthony DiClemente – SVP, IR Meredith Kopit Levien – President and CEO William Bardeen – EVP and CFO Conference Call Participants Benjamin Soff - Deutsche Bank Thomas Yeh - Morgan Stanley David Karnovsky - J.P. Morgan Chase Kannan Venkateshwar - Barclays Bank Vasily Karasyov - Cannonball Research Douglas Arthur - Huber Research Operator Good morning and welcome to The New York Times Company's Third Quarter 2024 Earnings Conference Call.

New York Times tech staff strike, threatening Election Day coverage

If the strikes persists through tomorrow, it will the first to coincide with a presidential election in 60 years, according to the union.

New York Times Co. (NYT) Q3 Earnings Surpass Estimates

New York Times Co. (NYT) came out with quarterly earnings of $0.45 per share, beating the Zacks Consensus Estimate of $0.42 per share. This compares to earnings of $0.37 per share a year ago.

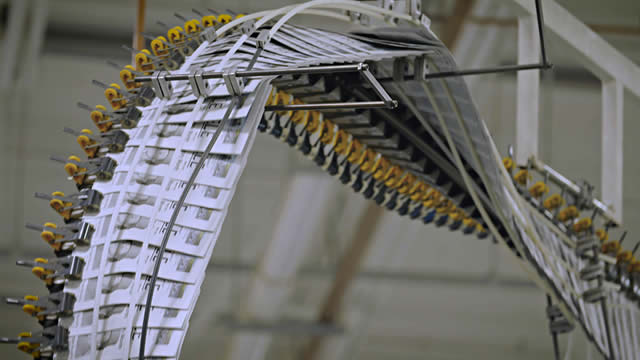

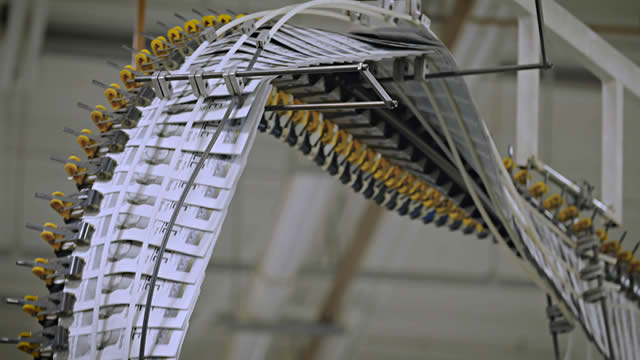

New York Times Tech Workers Go on Strike

The Times Tech Guild represents more than 600 software developers and others who run the back-end systems behind The Times's digital operation.

Countdown to New York Times (NYT) Q3 Earnings: Wall Street Forecasts for Key Metrics

Beyond analysts' top -and-bottom-line estimates for New York Times (NYT), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2024.

Assessing The New York Times Company Ahead of Q3 Earnings Release

The New York Times Company's third-quarter 2024 results are likely to reflect the company's greater emphasis on subscription revenues.

Chinese hackers targeted phones used by Trump and Vance, New York Times reports

Chinese hackers who tapped into Verizon's system targeted phones used by Donald Trump and his running mate JD Vance, the New York Times reported on Friday, citing people familiar.

JPMorgan CEO Jamie Dimon eyes Harris administration role: NYT

JPMorgan (JPM) CEO Jamie Dimon is reportedly considering a role in the Harris administration, according to a New York Times report. "I think the important thing to remember here is that probably 80% of the rank and file on Wall Street are Democrats, are progressives and probably do support Kamala Harris.

New York Times takes aim at another AI company

The New York Times has sent a cease and desist letter to Perplexity, a hot AI startup often touted as a promising competitor to Google search, over alleged copyright infringement.