Progressive Corporation (PGR)

Progressive (PGR) Up 1.7% Since Last Earnings Report: Can It Continue?

Progressive (PGR) reported earnings 30 days ago. What's next for the stock?

Progressive (PGR) Surpasses Market Returns: Some Facts Worth Knowing

Progressive (PGR) concluded the recent trading session at $204.08, signifying a +1.14% move from its prior day's close.

The Progressive Corporation (PGR) is Attracting Investor Attention: Here is What You Should Know

Progressive (PGR) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Progressive's January Earnings Increase Y/Y on Higher Premiums

PGR's January results reflect higher revenues and a rise in investment income, partially offset by an increase in expenses.

The Progressive Corporation (PGR) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Progressive (PGR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Progressive's Q4 Earnings & Revenues Beat Estimates on Higher Premiums

PGR's fourth-quarter 2025 results reflect a year-over-year improvement in premiums.

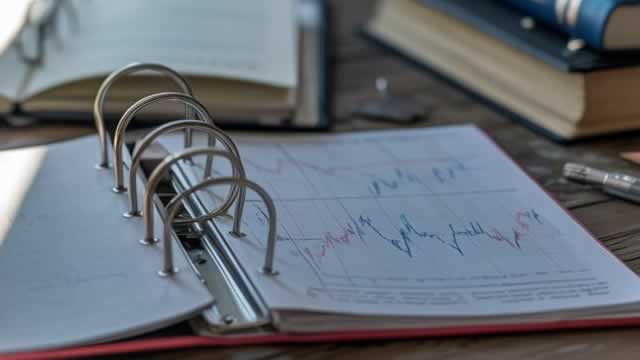

Progressive (PGR) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Progressive (PGR) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Progressive: Margin Fears Are Overdone (Upgrade)

Progressive is upgraded to "Buy" as shares reach my $210 target, trading at ~12x earnings with a de-risked valuation. PGR's Q4 results beat estimates, with a strong 87.1% combined ratio and disciplined underwriting despite industry margin concerns. Premium growth is slowing as PGR prioritizes margins over volume, but policy count remains robust, up 10% year over year.

Progressive (PGR) Q4 Earnings and Revenues Top Estimates

Progressive (PGR) came out with quarterly earnings of $4.67 per share, beating the Zacks Consensus Estimate of $4.44 per share. This compares to earnings of $4.08 per share a year ago.

Progressive Set to Report Q4 Earnings: What's in Store?

PGR is expected to report higher Q4 earnings and revenues, driven by stronger premiums, investment income and policy growth.

Progressive (PGR) Beats Stock Market Upswing: What Investors Need to Know

Progressive (PGR) concluded the recent trading session at $206.92, signifying a +1.93% move from its prior day's close.

The Progressive Corporation (PGR) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Progressive (PGR). This makes it worthwhile to examine what the stock has in store.