Charles Schwab Corporation (SCHW)

There's often a conflating between Mag 7 performance and weight: Charles Schwab's Kevin Gordon

Kevin Gordon, Charles Schwab senior investment strategist, joins 'Squawk Box' to discuss the latest market trends, 2025 outlook, impact of AI, and more.

Charles Schwab: Positioned To Remain The Market Leader

Charles Schwab: Positioned To Remain The Market Leader

Market levels will represent a 'set up' at some point, says Charles Schwab's Liz Ann Sonders

Liz Ann Sonders, Charles Schwab chief investment strategist, joins 'Squawk on the Street' to discuss uncertainty around the Federal Reserve in 2025, the certainty the market needs, and much more.

There's a lot of sector rotation ahead, says Charles Schwab's Liz Ann Sonders

Liz Ann Sonders, Charles Schwab chief investment strategist, joins 'Closing Bell' to discuss the fuel for a continued market rally and rotation.

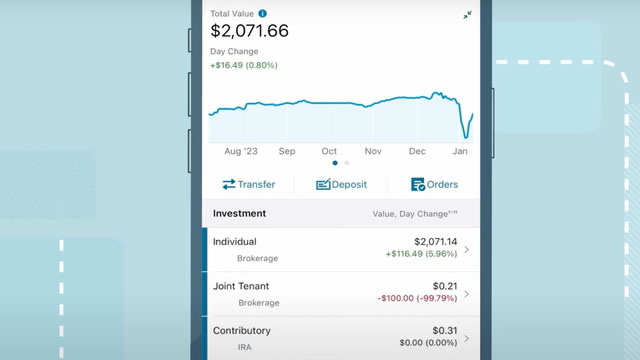

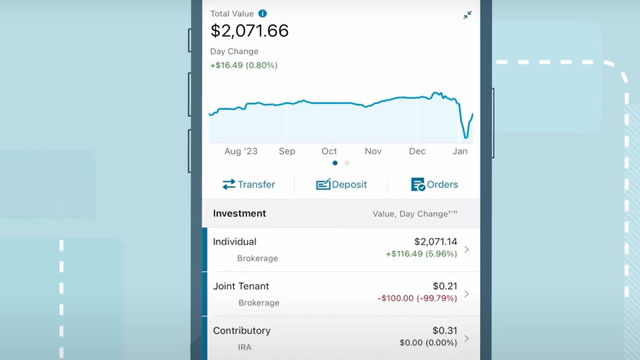

Schwab Ups 2024 Revenue View, Posts Higher November Client Assets

SCHW raises 2024 total revenue guidance and witnesses a solid increase in total client assets in November 2024.

We're seeing rotation into ETFs away from single stocks, says Charles Schwab's Joe Mazzola

Joe Mazzola, Charles Schwab head trading & derivatives strategist, joins 'Closing Bell Overtime' to talk positioning for year-end and beyond.

Clients bullish this quarter, demand for bitcoin ETFs picking up: Charles Schwab's head of trading

Joe Mazzola, Charles Schwab, joins 'Closing Bell Overtime' to talk retail trader trends he is seeing and how the cohort is playing bitcoin right now.

International markets could outperform on Trump's tariffs, says Charles Schwab's Jeffrey Kleintop

Jeffrey Kleintop, Charles Schwab chief global investment strategist, joins 'Squawk on the Street' to discuss the macro market and Trump's proposed tariffs impact on the economy, Fed and labor force.

Markets will be harder to navigate at the sector level, says Charles Schwab's Liz Ann Sonders

Liz Ann Sonders, Charles Schwab chief investment strategist, joins 'The Exchange' to discuss markets, what investors should expect ahead and equities.

Market Overtime: Incoming Charles Schwab CEO Rick Wurster

Oliver Renick sits down with Rick Wurster at the 2024 Schwab IMPACT conference in San Francisco, CA. Wurster will be assuming the CEO title on January 1, 2025 and discusses the path ahead for Charles Schwab heading into his new tenure.

The Charles Schwab Corporation (SCHW) Just Flashed Golden Cross Signal: Do You Buy?

The Charles Schwab Corporation (SCHW) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, SCHW's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross.

Charles Schwab incoming CEO talks growth, crypto plans

Charles Schwab (SCHW) president and incoming CEO Rick Wurster sits down with Yahoo Finance special reporter Rachelle Akuffo at the 2024 Schwab IMPACT conference to talk about his strategic outlook. Wurster will assume the chief executive mantle effective January 1, 2025.