Super Micro Computer Inc (SMCI)

Why Super Micro Computer Stock Jumped in November and Could Soar Even Higher

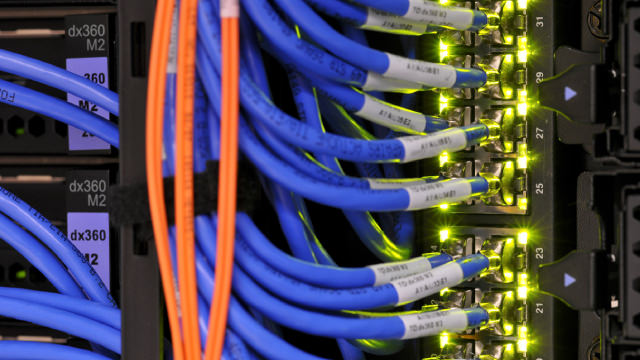

Super Micro Computer (SMCI 8.52%) stock had a big November and has begun December with a bang. It's been a somewhat hectic time for the supplier of artificial intelligence (AI) server stacks and coolant systems.

Up 30% On Monday, What's Next For Super Micro Stock?

Server maker Super Micro Computer stock (NASDAQ: SMCI) extended its recent rally, gaining close to 29% on Monday. The gains follow the company's release of an investigation into its accounts conducted by a special board committee, along with attorneys, and a forensic accounting firm, which found no evidence of fraud or misconduct by management.

Super Micro Probe Finds No Misconduct, But Analyst Says 'Visibility Into Compliance' Remains Low

Super Micro Computer Inc. SMCI has cleared a major hurdle, with its Special Committee's investigation finding "no evidence of misconduct/fraud" involving its management or board.

SMCI stock price surges 34%: ‘No evidence of misconduct,' but Super Micro Computer isn't out of the woods yet

Shares of Super Micro Computer, Inc. (Nasdaq: SMCI) stock surged more than 34% in midday trading on Monday after a special committee found “no evidence of misconduct” and the company announced a new chief accounting officer and that it was seeking a new chief financial officer.

Why SMCI stock is surging

After troubling months dominated by accounting concerns, the share price of Super Micro Computer (NASDAQ: SMCI) is rallying after it emerged that the artificial intelligence (AI) giant had no misconduct.

Super Micro Shares Jump 7% In Premarket As Special Committee Clears It Of 'Misconduct' Allegations, But Top Investment Bank Flags 2 Key Aspects To Watch

Super Micro Computer Inc. SMCI announced the completion of an independent review on Monday. The review, conducted by an Independent Special Committee, found no “evidence of misconduct” by the company's management or board.

Super Micro Stock Is Surging Again. These Questions Still Need Answers.

The AI server maker's shares were once again leading the S&P 500's biggest gainers early Tuesday, jumping 7% ahead of the open.

Super Micro stock rises almost 30% after misconduct allegations are scotched

Shares of Super Micro Computer Inc (NASDAQ:SMCI) rose almost 30% after hours after a special committee reaffirmed no evidence of misconduct at the AI server manufacturer and announced the appointment of Kenneth Cheung as chief accounting officer. The committee's report found no significant concerns about the integrity of senior management or the accuracy of financial statements.

Supermicro Stock Price Levels to Watch After Monday's Near-30% Surge

Super Micro Computer (SMCI) shares jumped nearly 30% Monday after the struggling server maker announced that an independent review of its accounting practices found no wrongdoing.

Super Micro Computer Shares Spike 29% After Company Says Review Found ‘No Evidence' Of Fraud

Shares of information technology firm Super Micro Computer closed up nearly 30% on Monday after the company said an independent committee found “no evidence of fraud or misconduct”—after a rocky 2024 marked by governance concerns raised by a former auditor and other alleged accounting issues.

S&P 500 Gains and Losses Today: Supermicro Surges as Independent Probe Concludes

Major U.S. equities indexes were mixed as December trading began, with many households eying Cyber Monday deals as U.S. retailers wrapped up a huge shopping weekend.

Super Micro Computer Just Made a Big Announcement and the Stock Is Soaring -- Is It Finally Time to Buy?

The accelerating adoption of artificial intelligence (AI) has been a boon to a number of players in the field and Super Micro Computer (SMCI 29.69%), commonly called Supermicro, has certainly been among them. The company supplies state-of-the-art servers designed specifically to handle the workloads that come with processing AI.