Stanley Black & Decker Inc. (SWK)

Here's Why You Should Retain Stanley Black Stock in Your Portfolio for Now

SWK gains from its cost-reduction program, divestiture of non-core assets and shareholder-friendly policies. Softness in the Tools & Outdoor unit remains concerning.

Here's Why Stanley Black & Decker Stock Slumped in October, and Why It Could Be a Buying Opportunity

The toolmaker's earnings report was disappointing, but understandable given the circumstances.

Stanley Black's Q3 Earnings Beat Estimates, Revenues Down Y/Y

Weakness in both segments weighs on SWK's top line in the third quarter of 2024.

Stanley Black & Decker Stock Falls as Tool Company Reports Consumer, Auto Weakness

Stanley Black & Decker (SWK) shares plunged as the toolmaker posted worse-than-expected results and narrowed its guidance, citing falling consumer demand and a slowdown in the auto sector.

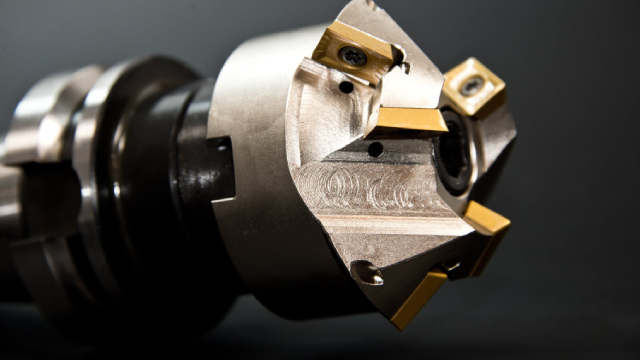

Zacks Industry Outlook Stanley Black & Decker and Techtronic Industries

Stanley Black & Decker and Techtronic Industries have been highlighted in this Industry Outlook article.

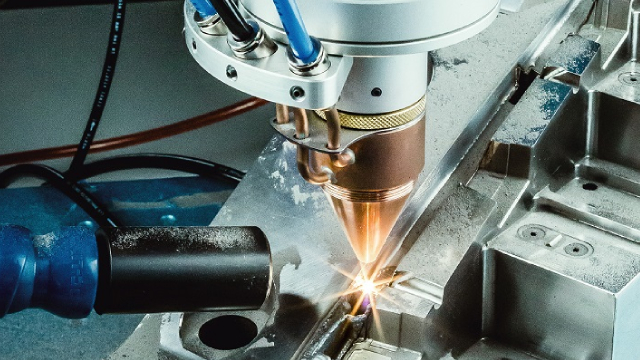

2 Manufacturing Tool Stocks to Overcome Industry Headwinds

Ongoing weakness in the manufacturing sector impacts the near-term outlook for the Zacks Manufacturing-Tools & Related Products industry. TTNDY and SWK are a couple of stocks to retain.

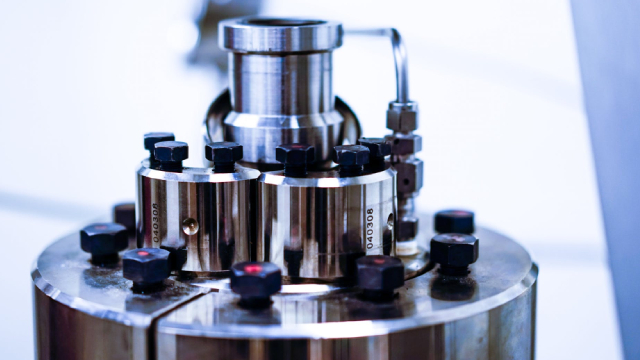

Is a Beat in the Offing for Stanley Black This Earnings Season?

SWK's Q3 2024 results are likely to gain from strength in the Engineered Fastening unit. However, the weakness in the Industrial and Tools & Outdoor segments is likely to have weighed on its performance.

Stanley Black Exhibits Bright Prospects, Headwinds Persist

SWK is set to benefit from its cost-reduction program, divestiture of non-core assets and shareholder-friendly policies.

Here's Why Stanley Black & Decker Stock Soared by 32% in July

Cost reduction plans are on track. The company generated organic growth in a different trading environment.

Stanley Black & Decker Might Have Found Its Bottom

Quarterly results show a decline in revenue but an increase in free cash flow, with the Tools & Outdoor segment performing better than the Industrial segment. Balance sheet analysis reveals still higher debt levels, but we are seeing progress in reducing the debt levels, and management will continue to put a focus here. Management focused on cost reduction programs and gaining market shares, with updated guidance showing mixed results but optimism for future growth.

Here's Why Stanley Black & Decker Slumped 19% in the First Half of 2024

A challenging sales environment threatens the company's ability to reduce inventory to normalized levels. A lower interest rate environment will help DIY tools sales.

The Smartest Turnaround Stock to Buy With $500 Right Now

Stanley Black & Decker hit a wall in 2022, and the pain lingered into 2023. But as a turnaround emerges, the toolmaker's earnings should see a strong rebound.