Teledyne Technologies Incorporated (TDY)

Teledyne (TDY) Up 7.2% Since Last Earnings Report: Can It Continue?

Teledyne (TDY) reported earnings 30 days ago. What's next for the stock?

Teledyne Accelerates to Maximum Velocity: $700 in Sight

Teledyne's NYSE: TDY price chart is a textbook example of an accelerating market with room to run higher. As of late January, it includes three consecutive green candles, large in size, rising sequentially to record highs in tandem with rising volume.

Teledyne's Momentum Makes Me Comfortable Buying At A Premium

Teledyne Technologies Incorporated delivered strong Q4 results, with EPS of $6.30 beating by $0.47 and revenue up 7.3% year-over-year. TDY's momentum is driven by robust defense demand, improving commercial activity, and record sales in autonomous and marine instrumentation. Digital Imaging led growth, especially in infrared components for unmanned systems, with segment margins improving to 22.6% for 2025.

Teledyne: Re-Rated As Belief In Long-Term Compounding Returns

Teledyne Technologies has regained strong momentum, with shares surging to all-time-highs at $620 on robust 2025 results and a positive 2026 outlook. Teledyne´ diversified, high-margin segments and disciplined bolt-on M&A strategy drive consistent mid-single-digit organic growth and incremental accretive acquisitions. Adjusted 2025 earnings rose 11% to $21.99/share; 2026 guidance targets $23.65/share, with earnings growth outpacing sales.

Teledyne (TDY) Reports Q4 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Teledyne (TDY) give a sense of how the business performed in the quarter ended December 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Teledyne Technologies (TDY) Tops Q4 Earnings and Revenue Estimates

Teledyne Technologies (TDY) came out with quarterly earnings of $6.3 per share, beating the Zacks Consensus Estimate of $5.83 per share. This compares to earnings of $5.52 per share a year ago.

Teledyne Technologies Incorporated (TDY) Q4 2025 Earnings Call Transcript

Teledyne Technologies Incorporated (TDY) Q4 2025 Earnings Call Transcript

Teledyne's Q4 Earnings & Revenues Beat Estimates, Increase Y/Y

TDY tops Q4 earnings and revenue estimates, posting double-digit profit growth and guiding higher adjusted earnings for 2026.

Teledyne Technologies to Report Q4 Earnings: Here's What to Expect

TDY heads into Q4 earnings with a recent acquisition, steady defense electronics demand and consensus forecasts pointing to mid-single-digit growth.

Insights Into Teledyne (TDY) Q4: Wall Street Projections for Key Metrics

Get a deeper insight into the potential performance of Teledyne (TDY) for the quarter ended December 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

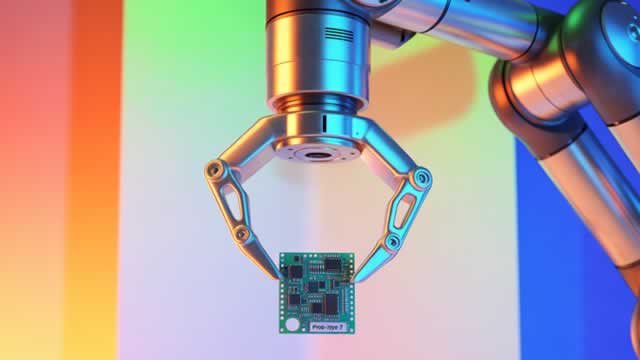

Teledyne Acquires DD-Scientific, Expands Gas Sensing Portfolio

TDY acquires DD-Scientific, adding advanced gas sensors to expand its sensing portfolio across medical, industrial safety and environmental markets.

Teledyne Technologies (TDY) Earnings Expected to Grow: Should You Buy?

Teledyne (TDY) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.