Target Corporation (TGT)

Rocket Lab Gets New Street-High Price Target from Citi

Rocket Lab USA NASDAQ: RKLB defies gravity, literally and figuratively. Already one of 2025's hottest stocks, Rocket Lab is now up over 75% year-to-date and has exploded more than 730% over the past twelve months.

Can TGT's AI Strategy Drive a Faster & Smarter Retail Transformation?

Target bets on AI to cut inefficiencies, boost execution speed and stay ahead of shifting consumer trends.

3 Analysts Set $600 Target Ahead of Microsoft Earnings

Many investors expect analysts to change their ratings after a company reports earnings. However, in many cases, investors can get clues about a company's upcoming earnings from analyst activity before the earnings report is released.

'Lost their identity': Why Target is struggling to win over shoppers and investors

Target's shares have plummeted and annual sales have stagnated for four years. Customers, vendors and former employees told CNBC that the discounter has lost some of the unique traits that helped it stand out, including its eye-catching merchandise, attentive staff and well-kept stores.

Target Corporation (TGT) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Target (TGT). This makes it worthwhile to examine what the stock has in store.

Harrow's Internal $100 Price Target Is Ambitious, But New Bloomberg Data Backs It Up

Harrow's new 3-year share-based compensation plan sets ambitious share price targets, with awards at $50, $60, $75, and $100. The two previous plan targets were quickly surpassed, suggesting management is willing to set easily achievable SBC target prices. HROW acquired BYQLOVI for US distribution with minimal upfront cost, leveraging its proven distribution-focused business model to add another drug with $100M potential. Bloomberg reported stellar growth for HROW's most important drugs in Q2 2025, with growth coming in at 30% to more than 60% compared to Q1.

Lamb Weston: This Could Be The Next Food Stock Takeover Target

Lamb Weston Holdings, Inc. appears undervalued, trading at 16x 2025 earnings, with improving profit estimates and a defensive business model in the food sector. Operational turnaround initiatives and cost savings could significantly boost profitability, while activist investor Jana Partners increases buyout potential. Share buybacks and a dividend yield of nearly 3% offer shareholder value, especially if interest rates decline.

Why Target (TGT) Outpaced the Stock Market Today

Target (TGT) concluded the recent trading session at $104.74, signifying a +2.26% move from its prior day's close.

Kinross Gold: A Healthy And Undervalued Acquisition Target

Kinross Gold remains undervalued despite strong outperformance, offering a compelling entry point with attractive free cash flow and solid asset quality. The company boasts a strong balance sheet, manageable debt, stable production, and could be well-positioned for a potential acquisition. Kinross offers a sustainable yield through dividends and buybacks, supported by robust cash flows and a disciplined capital allocation strategy.

Demand Returns for Delta, Sets New Profit Target

Delta Air Lines Inc. issued a new profit target for this year after pulling the goal three months ago, in a sign that demand is bouncing back from the initial shock over US President Donald Trump's tariff war. Earnings came in above Wall Street estimates.

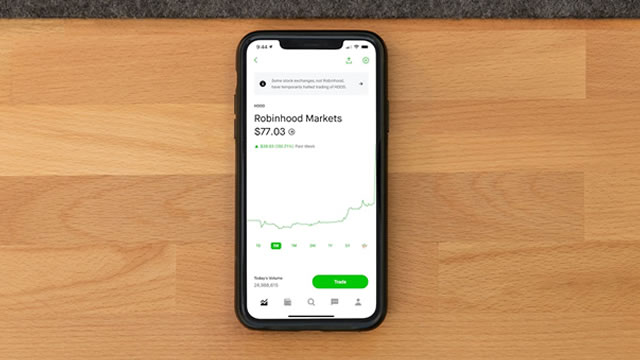

Robinhood Stock Gets 5 Price Target Upgrades, Signaling Upside

Robinhood Markets NASDAQ: HOOD missed out on inclusion in the S&P 500, but the last thing the company is doing is focusing on the past. The firm just announced innovations that have Wall Street analysts swooning.

Can Remodeling Efforts Revive Target's In-Store Traffic Trends?

TGT bets on store remodels to revive traffic, targeting 2-4% comp lifts and deeper gains in the second year post-update.