Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching TSMC (TSM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

AI Boom Fuels Taiwan Semiconductor's Growth: Will It Sustain Momentum?

TSM's quarterly revenues surge 40.8% as AI chip demand soars, driving record 3nm and 5nm orders and fueling a global expansion push.

TSMC shares steady despite slowdown in monthly sales growth

Taiwan Semiconductor Manufacturing Co (ADR) (NYSE:TSM) shares were little changed on Tuesday, suggesting investors remain largely unfazed by signs of slower growth at the world's leading chipmaker. TSMC reported a 16.9% year-on-year increase in October sales, its weakest monthly growth since February 2024 but broadly in line with analyst expectations.

Taiwan Semiconductor (TSM) Stock Is a Buy Despite Slowing Sales Growth

In-the-know traders see Taiwan Semiconductor Manufacturing (NYSE:TSM) as global powerhouse among chipmakers.

Taiwan Semiconductor sees October revenue surge, boosted by AI chip demand

Taiwan Semiconductor Manufacturing Co (ADR) (NYSE:TSM) (TSMC) on Monday announced that its revenue in October rose 16.9% year over year to T$367.47 billion (US$11.86 billion), a new monthly record for the company, while also improving 11% from September. The results, though, marked the slowest pace of growth for TSMC since February 2024.

TSMC Sales Growth Slows. What That Means for the AI Trade.

TSMC reported its slowest pace of monthly sales growth since February 2024.

TSM Stock Trades Near 52-Week High: Time to Hold or Book Profits?

Taiwan Semiconductor's AI-fueled growth keeps it near record highs, but expansion costs suggest a cautious hold.

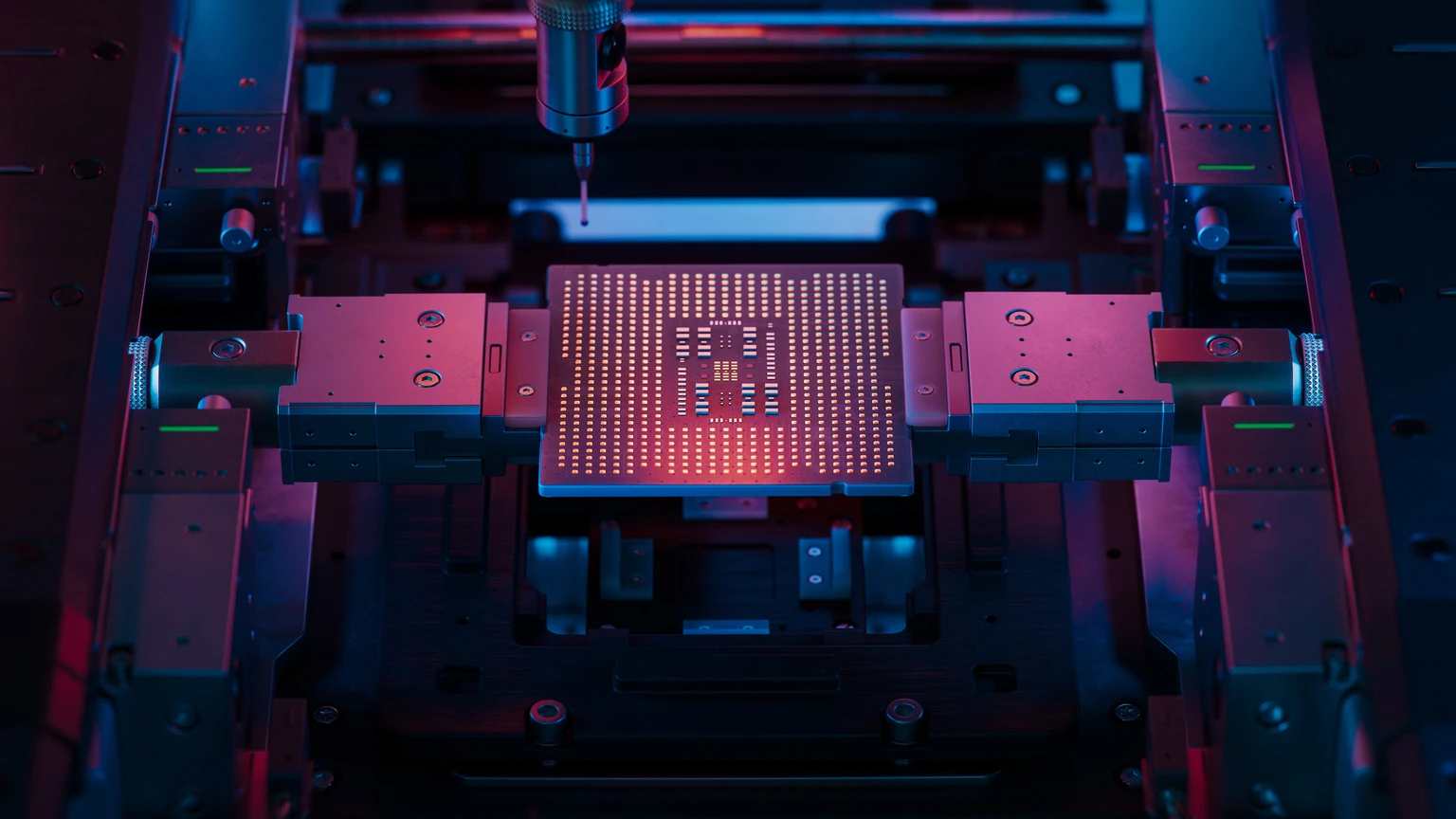

$14B Japanese Facility Signals TSMC's Bold AI Strategy

The artificial intelligence (AI) boom has unleashed a historic, seemingly insatiable demand for advanced computing power. At the epicenter of this technological revolution stands one company: Taiwan Semiconductor Manufacturing NYSE: TSM (TSMC), the critical manufacturing partner for nearly every major AI chip designer.

TSMC's 2nm Node: Will It Power the Next Growth Cycle or Pressure Margins?

TSM's bold 2nm expansion may squeeze margins in the short term but could secure long-term gains as AI chip demand accelerates.

Is TSM's Global Fab Push a Wise Expansion Move or a Costly Overreach?

Taiwan Semiconductor's bold global fab expansion fuels soaring AI chip demand and supply-chain resilience, even as margins face short-term pressure.

TSMC: Trimming 50% Of My Position After An Impressive Quarter

Taiwan Semiconductor (TSM) remains a buy after a strong rally, with 50% of my long position closed to lock in gains. TSMC delivered robust Q3 results, with net income up 39.1% YoY and revenue growth driven by high-performance computing and AI demand. Despite premium valuations and potential for multiple compression, TSM's superior margins and capital returns justify its current pricing versus peers.

TSMC: There's No Other Company To Match Its Prowess (Rating Upgrade)

Taiwan Semiconductor delivered strong Q3 results, with 41% revenue growth, robust margins, and continued dominance in advanced chip manufacturing. TSM benefits from surging AI and HPC demand, maintaining a technological edge and deep relationships with key customers like NVDA, AAPL, and AMD. Despite concerns over AI exuberance, potential cyclicality, and geopolitical risks, TSM's financial strength and global presence support long-term resilience.