Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

TSMC Revenue Rises 39% Amid AI Spending Boom

TSMC's revenue rose a better-than-anticipated 39% in the June quarter. The chipmaker for Nvidia and Apple sales climbed to NT$934 billion ($32 billion) for the three months, beating the average analyst projection for about NT$928 billion.

TSMC posts Q2 sales of T$933.8 billion, above forecasts

TSMC , the world's largest contract chipmaker, reported on Thursday second-quarter revenue of T$933.80 billion ($31.9 billion), beating market forecasts, as demand for the company's products leaps on surging interest in artificial intelligence (AI) applications.

TSMC (TSM) is a Great Momentum Stock: Should You Buy?

Does TSMC (TSM) have what it takes to be a top stock pick for momentum investors? Let's find out.

I Sold TSMC To Lock In AI Gains, Now I'm Rotating Into Healthcare (Downgrade)

I sold my TSMC stock for a weighted 32.4% gain over the past three months. I've redeployed profits predominantly into healthcare, but also into higher-alpha tech. TSMC has a remarkable macro growth backdrop, but the stock is way too expensive right now to buy. I'm expecting a 10-15% return for TSMC stock over the next 12 months, that's why I encourage my readers to look elsewhere for higher-alpha opportunities.

Bull of the Day: Taiwan Semi (TSM)

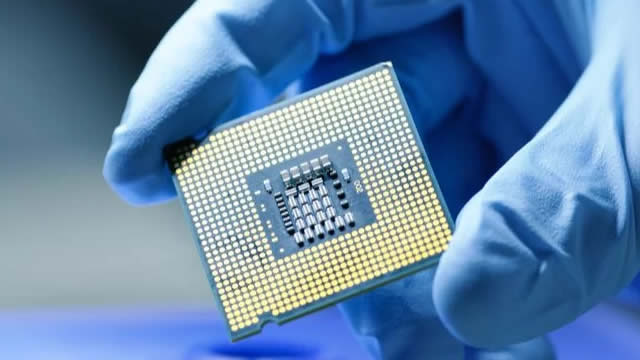

Taiwan Semiconductor ( TSM ) is the premier chip fabrication company for the world's most advanced digital technologies, from Apple smartphones to NVIDIA GPUs. In less than five years, TSMC's trailing 12-month revenue has more than doubled to hit $95 billion as of the March quarter.

TSMC's Dominance Is Intact, And The Valuation Still Works

Taiwan Semiconductor Manufacturing Company Limited remains a Buy as AI-driven demand accelerates, with Big Tech capex and sovereign AI investments supporting a bullish multi-year cycle. Tariff risks have faded, and 2026 growth visibility is improving, pushing out concerns of a semiconductor downcycle. Key risks include Taiwan's geopolitical tensions and currency headwinds.

TSMC (TSM) Registers a Bigger Fall Than the Market: Important Facts to Note

TSMC (TSM) reached $229.17 at the closing of the latest trading day, reflecting a -2.4% change compared to its last close.

TSMC to delay Japan chip plant and prioritize US to avoid tariffs: report

TSMC says its investment plans in the US would not impact existing investment plans in other regions

TSMC Is Making a Huge Investment in the U.S. Why That Could Be a Problem.

Taiwan Semiconductor Manufacturing could find it difficult to balance its commitments to the Trump administration and other national governments.

TSMC to Delay Japan Chip Plant and Prioritize U.S. to Avoid Trump Tariffs

The Taiwanese semiconductor maker is pouring funds more quickly into U.S. expansion.

TSM Stock Hits 52-Week High: Is It Time to Book Profits or Buy More?

Taiwan Semiconductor hits a 52-week high as AI chip demand surges, earnings soar, and valuation still leaves room for upside.

Why Taiwan Semiconductor (NYSE: TSM) Is Poised to Smash Earnings Expectations

Taiwan Semiconductor (NYSE: TSM) reported May revenue up 40% year-over-year, beating expectations despite macro concerns, pointing to continued AI-driven demand.