Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Why TSMC (TSM) Dipped More Than Broader Market Today

In the closing of the recent trading day, TSMC (TSM) stood at $146.16, denoting a -0.44% change from the preceding trading day.

Taiwan Semiconductor Spared From New Tariffs: Bullish Path Ahead?

President Trump has announced the latest round of trade tariffs, targeting a wide range of goods from most of the United States' trading partners, with a particular impact on the retail sector.

Prediction: Taiwan Semiconductor Manufacturing Will Soar Over the Next 5 Years. Here's 1 Reason Why.

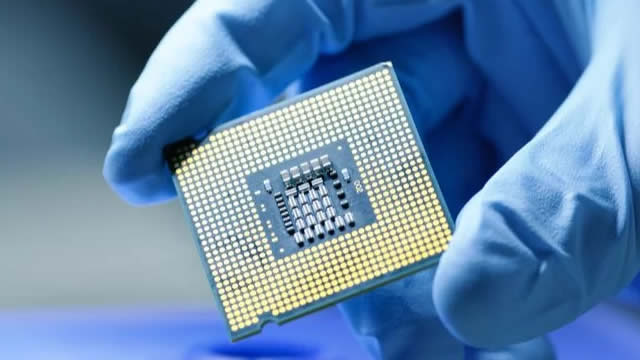

Taiwan Semiconductor Manufacturing (TSM -6.68%) is the world's leading semiconductor (chip) foundry. Its foundry business model means it makes chips tailored to its customers' specific needs, and key partners include Nvidia, Apple, and Advanced Micro Devices.

1 Magnificent Artificial Intelligence (AI) Stock Down 25% to Buy Hand Over Fist Before April 17

Taiwan Semiconductor Manufacturing (TSM -6.68%), popularly known as TSMC, is having a forgettable 2025 so far despite starting the year on a bright note. Shares of the foundry giant have slipped by more than one-third from the 52-week high they achieved on Jan. 24.

TSMC: AI's Most Critical Supplier Is On Sale

TSMC produces over 90% of the world's advanced AI chips, including Nvidia's H100, AMD's MI300X, and Google's TPU. AI infrastructure spending is projected to grow from $230B in 2024 to over $300B in 2025, directly benefiting TSMC. TSMC's CoWoS packaging triples capacity by 2025, enhancing AI chip efficiency and capturing high-margin revenue.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to TSMC (TSM). This makes it worthwhile to examine what the stock has in store.

2 Monster Stocks to Hold for the Next 5 Years

After two years of a roaring bull market, the S&P 500 just had its worst month since 2022, falling 5.8% in March. Multiple factors are pressuring stocks, including fears about President Donald Trump's trade war, weakening consumer sentiment, valuation-related pressure, and inflation remaining higher than the Fed's target of 2%.

TSM, WMT & JBHT: Charting Suppliers in A.I., Retail & Transit

Today's Chart Master focuses on three key suppliers in their respective industries. Jenny Horne turns to Walmart (WMT) seeking assistance from Chinese suppliers, Barclays adjusting its J.B.

TSMC (TSM) Ascends But Remains Behind Market: Some Facts to Note

The latest trading day saw TSMC (TSM) settling at $166, representing a +0.45% change from its previous close.

TSMC's Supercycle Is Just Warming Up

TSMC's 3nm and 5nm nodes drove 60% of wafer revenue in Q4-FY24, fueling 38.8% YoY topline growth. HPC revenue rose to 53% of total sales in Q4-FY24, up from 43% a year earlier. January–February FY25 revenue reached NT$553.3B, marking a 39.2% YoY increase despite seasonal smartphone softness in February.

Taiwan Semiconductor: Be Greedy When Others Are Fearful

Since my last writing, two new catalysts have further skewed TSM stock's return/risk curve and promoted me to upgrade its rating to strong buy. First, the latest world semiconductor trade statistics showed a significant 18% YOY jump in semiconductor sales. Second, TSM announced a $100B U.S. expansion plan to meet rising demand.

TSMC Expects $2 Trillion of Products to Use Its Next Chip Technology Within 5 Years

A new factory is on schedule to manufacture 2-nanometer chips in volume during the second half of this year.