Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Prediction: This Will Be the Top-Performing Chip Stock Over the Next 10 Years (Hint: It's Not Nvidia)

Over the last couple of years, semiconductor stocks have been some of the biggest beneficiaries of the market's newest megatrend, artificial intelligence (AI). In particular, suppliers of graphics processing units (GPUs) to data centers such as Nvidia and Broadcom have witnessed abnormally high gains relative to those seen across the S&P 500 and Nasdaq Composite.

If I Could Only Buy 1 Chip Stock, This Would Be It

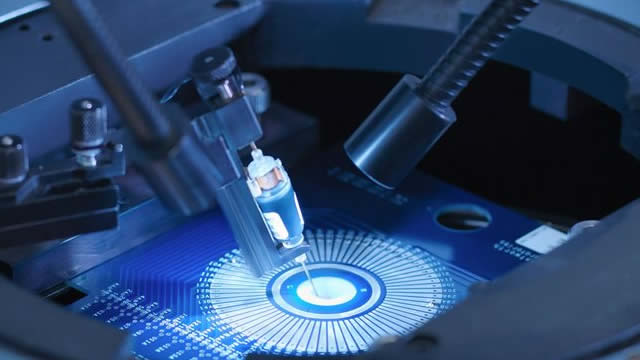

Chip investing has become a huge part of many investors' portfolios, whether they understand it or not. Chips are in nearly every device that consumers buy, but some of the most high-powered chips are produced by one company: Taiwan Semiconductor Manufacturing (TSM -0.88%).

Taiwan Semiconductor: Another Buying Opportunity Materializes (Technical Analysis) (Rating Upgrade)

Taiwan Semiconductor's recent earnings report shows strong profitability, driven by high-end AI chip sales, justifying a "strong buy" rating with potential for further gains in 2025. TSM's forward P/E ratio of 22.62x is significantly lower than competitors like Nvidia and Intel, indicating undervaluation and potential for price appreciation. Despite elevated forward price-sales ratio, technical indicators suggest recent downturns are overdone, presenting a buying opportunity as the stock nears the -2 Standard Deviation channels.

AVGO & TSM Eye Deals to Split INTC, Stock Climbs

Broadcom (AVGO) and TSMC (TSM) each have their own plans to take a piece of Intel's (INTC) business, according to the Wall Street Journal. The American chip company saw a recent week-long rally after the Trump administrator promised to bolster U.S. strength in the A.I.

Billionaire Philippe Laffont Sold 80% of Coatue's Stake in Nvidia and Is Piling Into This Critical Artificial Intelligence (AI) Infrastructure Stock Instead

You might not realize it, but arguably the most important data dump of the first quarter occurred on Friday, Feb. 14.

Brokers Suggest Investing in TSMC (TSM): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

If You Only Own the Vanguard S&P 500 ETF, You're Missing Out on This Brilliant Artificial Intelligence (AI) Semiconductor Stock

One of the most popular ways to invest in stocks is to buy the Vanguard S&P 500 ETF (VOO 0.00%). The Vanguard fund is popular for a reason: Its long record of closely tracking the S&P 500, combined with its low expense ratio, makes it a top S&P 500 index fund.

TSM Can Be A Surprise Winner In The Tariff War

TSM stock can be a big winner amid tariff tensions as the company increases its presence within the US, after the recent White House request. We could see some short-term adjustments in AI capex by companies as more effort is put on efficiency instead of adding computing power. However, the larger trend is that TSM is a market leader in chip fabrication and any future demand will be captured by the company.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching TSMC (TSM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

TSMC: OpenAI Partnership Changes The Game

TSMC remains a top AI investment due to its dominant market position, strategic alliances, and cutting-edge technologies, despite geopolitical risks. In the long term, I expect to see TSMC's key margins stay where they are now (on a seasonality-adjusted basis) and probably even go up slightly. OpenAI's partnership with TSMC for in-house AI chip fabrication is a strong bullish sign, reinforcing my conviction.

TSMC: AI Foundry Leader For GPUs And ASICs

TSMC management has indicated enormous AI opportunity for its foundry business, particularly for GPUs and ASICs. TSMC has a customer group of high caliber technology leaders that is driving its foundry demand. With continuous development in foundry and advanced packaging solutions, we believe TSMC remains the top global foundry and a tremendous stock to buy.

Will Potential Tariffs on Taiwan Semiconductor Manufacturing Sink the Stock?

Taiwan is a global chip manufacturing hot spot, home to companies like Taiwan Semiconductor Manufacturing (TSM -2.08%), which fabricates chips used in nearly every high-end technology. TSMC is a vital supplier to the artificial intelligence (AI) computing power arms race, and slapping a tariff on products that come from Taiwan could be a big hurdle for domestic AI companies to clear.