Visa Inc. Class A (V)

Visa-UnionPay Link-Up: A Turning Point in Cross-Border Money Flow?

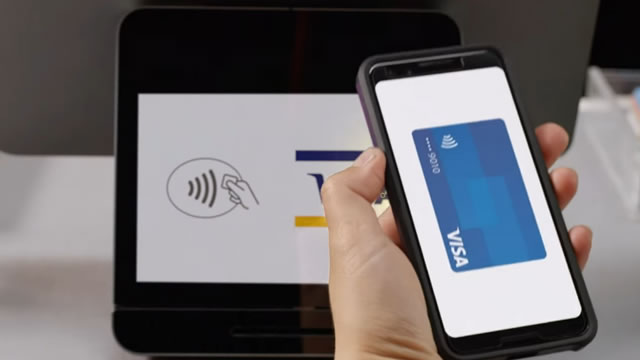

V links Visa Direct with UnionPay's MoneyExpress, opening cross-border payouts to 95% of UPI debit cards in China via one integration.

Here's Why Visa (V) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Visa Inc. (V) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Visa (V). This makes it worthwhile to examine what the stock has in store.

Visa Beats Q1 Earnings on Volume Muscle, Shrugs Off Processing Miss

V beats fiscal Q1 EPS and revenues as payment and cross-border volumes rise, offsetting a slight processing miss and higher operating costs.

Visa Credentials Soar as Payments Hyperscaler Eyes Agentic Commerce

Visa entered fiscal 2026 with ample evidence that credentials, and not just cards, now anchor its global payments architecture. Management commentary spanned agentic commerce, stablecoins, as well as in B2B and P2P money movement, and CEO Ryan McInerney said during the Thursday (Jan.

Visa Inc. (V) Q1 2026 Earnings Call Transcript

Visa Inc. (V) Q1 2026 Earnings Call Transcript

Visa (V) Reports Q1 Earnings: What Key Metrics Have to Say

The headline numbers for Visa (V) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Visa (V) Tops Q1 Earnings and Revenue Estimates

Visa (V) came out with quarterly earnings of $3.17 per share, beating the Zacks Consensus Estimate of $3.14 per share. This compares to earnings of $2.75 per share a year ago.

Visa Earnings Preview: What to Watch When V Reports Today

Get earnings reminders, our top analysis on Visa, market updates, and brand-new stock recommendations delivered directly to your inbox.

The Zacks Analyst Blog Visa, Mastercard, and PayPal

Visa deepens its role in digital payments by partnering with Mercuryo to enable near real-time crypto-to-fiat payouts via Visa Direct.

Visa vs. Mastercard: Is There a Better Buy?

Both financial titans are on the reporting docket this week, helping headline a jam-packed earnings docket overall. Both stocks have nearly mirrored performances over the past five years, gaining 70%.

Visa Strengthens Crypto-to-Fiat Access Through Mercuryo Partnership

V partners with Mercuryo to enable near-instant crypto-to-fiat conversions, boosting global digital payment access.