Walmart Inc. (WMT)

WMT's U.S. Segment Momentum: Are 4.6% Comp Sales Sustainable for FY27?

Walmart delivers 4.6% comp growth in Walmart U.S. for FY26, fueled by traffic, grocery strength and e-commerce momentum heading into FY27.

Here is What to Know Beyond Why Walmart Inc. (WMT) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Walmart (WMT). This makes it worthwhile to examine what the stock has in store.

ETFs in Focus as Walmart Loses Its Largest Retailer Title to Amazon

VCR and peers offer diversified exposure as Amazon tops Walmart with $716.9B in 2025 revenues, powered by AWS and a $60B ad business.

Walmart vs. Amazon: Which Trillion-Dollar Stock Is a Better Buy Right Now?

Walmart is showing excellent revenue and earnings growth in the face of economic uncertainty. Amazon's cloud computing business is accelerating as it steps up its AI spending plans.

How Walmart Is Defending Its Crown Against Competitors

Walmart‘s stock has outperformed the majority of its competitors over the previous year as of 2/19/2026. The momentum follows solid Q4 FY2026 results, where the company reported roughly $190.7 billion in revenue, up about 5.6% year over year, with operating income rising at a faster pace and e commerce sales climbing more than 20%.

ETFs to Watch as Walmart Shares Slip Despite Q4 Earnings Beat

Shares of Walmart Inc. WMT slipped 1.4% yesterday, following the company's better-than-expected fourth-quarter fiscal 2026 results. Despite comfortably surpassing analysts' estimates for earnings and revenues, the retail giant's stock tumbled at the bourses, most likely owing to its earnings outlook for fiscal 2027, which fell short of Wall Street's expectations.

Walmart Q4: Too Expensive To Support Forward Operating Income Growth Expectations

Walmart delivered strong Q4 2026 results, with operating income up 10.8% on 5.6% sales growth (reported basis), highlighting early benefits from automation. Despite operational efficiencies, WMT's FY 2027 operating income growth outlook of 7% is insufficient to justify its elevated valuation multiples. I rate WMT a Hold, citing a disconnect between profitability improvements and a rich valuation—nearly 50x forward earnings and 35x forward EBIT.

Sell Walmart Before It Loses Its $1 Trillion Valuation

Walmart delivered decent Q4 results, with strong eCommerce growth and resilient U.S. comparable sales, but overall revenue growth is decelerating. Margin improvements and disciplined cost control drove double-digit operating income and EPS growth, outpacing top-line gains. FY2027 guidance projects 4% sales and 7% operating income growth, yet valuation remains extremely elevated versus sector and historical averages.

Amazon Is Now America's Biggest Company. Its 17-Year Journey to Surpass Walmart.

Walmart had held the title as the biggest company by annual revenue since 2009.

Retail Giant Beats Estimates Amid Tech-Driven Evolution

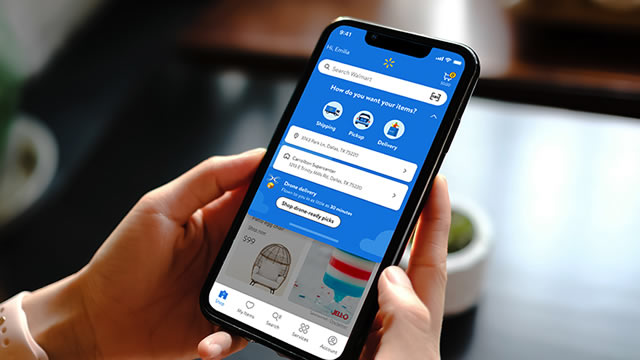

The results come amid Walmart's broader AI push, positioning the retailer more like a tech-enabled company rather than a traditional brick-and-mortar giant.

Walmart Pushes Price Cuts and Fast Delivery as Wallets Tighten

Talk about raining on the parade. New Walmart CEO John Furner's first earnings call was dampened by the news Thursday morning (Feb. 19) that it had been surpassed by Amazon in terms of total sales.

Walmart Inc. (WMT) Q4 2026 Earnings Call Transcript

Walmart Inc. (WMT) Q4 2026 Earnings Call Transcript