Zebra Technologies Corporation (ZBRA)

Zebra Technologies: Everything Works, But The Price Is Already Right

Zebra Technologies has restored margins, cash flow, and operational strength, but the current stock price already reflects these improvements. The company has successfully diversified its supply chain and reduced China exposure, yet tariff risks and market perception still weigh on sentiment. Valuation is fair, with limited upside unless new catalysts—like regulatory easing or accelerated AI/software growth—materialize.

Here's Why Investors Should Consider Buying Zebra Technologies Now

ZBRA shares surge 44.6% in three months as strong segment growth, acquisitions and solid cash flow fuel bullish investor sentiment.

Zebra Technologies Unveils EM45 Android-Based Enterprise Mobile Computer

ZBRA introduces EM45 Enterprise Mobile with AI power, dual profiles and a 25-hour battery to boost frontline workforce productivity.

Zebra (ZBRA) Up 16.2% Since Last Earnings Report: Can It Continue?

Zebra (ZBRA) reported earnings 30 days ago. What's next for the stock?

How Zebra Technologies Is Dodging Tariff Costs While Others Panic

Data management expert Zebra Technologies (ZBRA 2.50%) reported first-quarter results on April 29. Revenues rose 11% year over year while earnings jumped 42% higher.

Zebra Technologies Corporation (ZBRA) Q1 2025 Earnings Call Transcript

Zebra Technologies Corporation (NASDAQ:ZBRA ) Q1 2025 Earnings Conference Call April 29, 2025 8:30 AM ET Corporate Participants Mike Steele - Vice President, Investor Relations Bill Burns - Chief Executive Officer Nathan Winters - Chief Financial Officer Conference Call Participants Jamie Cook - Truist Piyush Avasthy - Citi Brad Hewitt - Wolfe Research Andrew Buscaglia - BNP Paribas Damian Karas - UBS Tommy Moll - Stephens Guy Hardwick - Freedom Capital Markets Karan Juvekar - Morgan Stanley Keith Housum - Northcoast Research Ken Newman - Keybanc Capital Markets Joe Giordano - TD Cowen Rob Mason - Baird Chris Grenga - Needham & Co. Operator Good day and welcome to the First Quarter 2025 Zebra Technologies Earnings Conference call. All participants will be in listen-only mode.

Zebra Technologies Q1 Earnings & Revenues Top Estimates, Rise Y/Y

ZBRA's first-quarter 2025 revenues surge 11.3% year over year, driven by strength in the Asset Intelligence & Tracking and Enterprise Visibility & Mobility segments.

Zebra Technologies (ZBRA) Q1 Earnings and Revenues Top Estimates

Zebra Technologies (ZBRA) came out with quarterly earnings of $4.02 per share, beating the Zacks Consensus Estimate of $3.60 per share. This compares to earnings of $2.84 per share a year ago.

Zebra Technologies Gears Up to Post Q1 Earnings: What's in Store?

ZBRA's Q1 results are likely to benefit from the solid demand for mobile computing products and data capture solutions. High costs and expenses are likely to hurt its bottom-line results.

Here's Why Investors Should Avoid Zebra Technologies for Now

Increasing costs and high debt levels are weighing on ZBRA. Unfavorable foreign currency movement is an added concern.

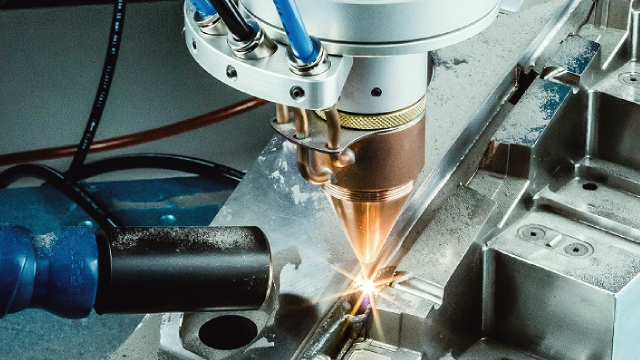

Zebra Technologies Acquires Photoneo & Boosts Product Portfolio

ZBRA's acquisition of Photoneo is set to strengthen its product offerings and boost its position in the 3D machine vision solutions industry.

Here's Why You Should Avoid Investing in Zebra Technologies Now

Rising costs, high debt level and unfavorable foreign-currency movement are weighing on ZBRA's performance.