IDEX Corporation (IEX)

Here's Why You Should Retain IDEX Stock in Your Portfolio Now

IEX gains from solid momentum across the FSDP and FMT segments, accretive acquisitions and shareholder-friendly policies.

Why Is Idex (IEX) Up 5.7% Since Last Earnings Report?

Idex (IEX) reported earnings 30 days ago. What's next for the stock?

IDEX Corporation (IEX) Q3 2024 Earnings Call Transcript

IDEX Corporation (NYSE:IEX ) Q3 2024 Earnings Conference Call October 30, 2024 10:30 AM ET Company Participants Wendy Palacios - Vice President, Investor Relations, FP&A Eric Ashleman - Chief Executive Officer & President Abhi Khandelwal - Senior Vice President & Chief Financial Officer Conference Call Participants Deane Dray - RBC Capital Markets Nathan Jones - Stifel Mike Halloran - Baird Vlad Bystricky - Citigroup Jeff Sprague - Vertical Research Partners Andrew Buscaglia - BNP Paribas Brett Linzey - Mizuho Joe Giordano - TD Cowen Rob Wertheimer - Melius Research Operator Greetings, and welcome to the Third Quarter 2024 IDEX Corporation Earnings Conference Call. At this time, all participants are in a listen-only mode.

IDEX Q3 Earnings Surpass Estimates, Sales Increase Year Over Year

Strength in the Fire & Safety/Diversified Products segment aids IEX's third-quarter results.

Idex (IEX) Reports Q3 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Idex (IEX) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Idex (IEX) Q3 Earnings and Revenues Beat Estimates

Idex (IEX) came out with quarterly earnings of $1.90 per share, beating the Zacks Consensus Estimate of $1.89 per share. This compares to earnings of $2.12 per share a year ago.

IDEX Gears Up to Post Q3 Earnings: What Lies Ahead for the Stock?

Weakness in the HST and FMT segments and escalating operating expenses are likely to hurt IEX's third-quarter results.

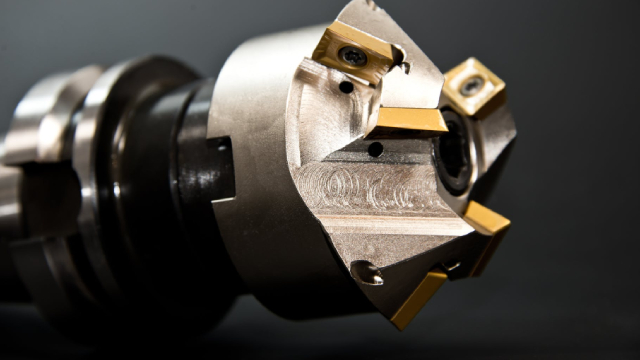

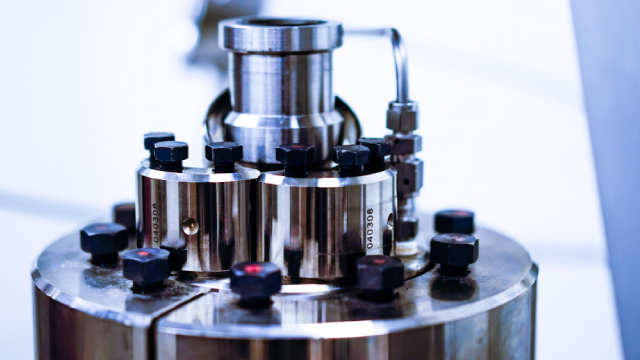

IDEX Boosts Product Portfolio With the Acquisition of Mott

IEX is set to penetrate and diversify its offerings in key markets, such as semiconductor fabrication, medical technologies and water purification, with the acquisition of Mott.

IDEX Corp. Q2: Project Delay And Weakness In Life Science

I reiterate a 'Buy' rating for IDEX, with a fair price target of $220 per share, despite near-term headwinds in organic revenue and market softness. IDEX's acquisition of Mott Corporation for $1 billion is strategically favorable, enhancing their applied material science technology and potentially improving overall margins. Project delays and market weakness, particularly in the life science sector, have led to a 4% organic revenue decline and lowered full-year growth guidance.

Idex (IEX) Up 4.5% Since Last Earnings Report: Can It Continue?

Idex (IEX) reported earnings 30 days ago. What's next for the stock?

Here's Why You Should Avoid Investing in IDEX (IEX) for Now

Softness in the analytical instrumentation, life sciences and semiconductor markets and increasing operating expenses weigh on IDEX (IEX). Unfavorable foreign currency movement is an added concern.

Idex (IEX) Reports Q2 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Idex (IEX) give a sense of how its business performed in the quarter ended June 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.