AES Corporation (AES)

Boomers Love These 5 Stocks Under $20 That Pay Huge and Growing Dividends

Investors love dividend stocks, especially high-yield varieties, because they offer a significant income stream and have substantial total return potential.

Is AES (AES) Stock Outpacing Its Utilities Peers This Year?

Here is how AES (AES) and Ameren (AEE) have performed compared to their sector so far this year.

Should Value Investors Buy AES (AES) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Should You Buy, Sell or Hold AES Stock After a 9.2% Rise in a Month?

AES stock jumps 9.2% in a month as renewables, data center demand, and a growing contracted backlog fuel growth despite balance-sheet concerns.

AES (AES) Moves 9.2% Higher: Will This Strength Last?

AES (AES) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

Why AES (AES) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

AES vs. DUK: Which Is Better Positioned for Rising Power Demand?

AES and Duke Energy are ramping up grids and clean power as AI data centers drive electricity demand, but fundamentals point to one utility with an edge.

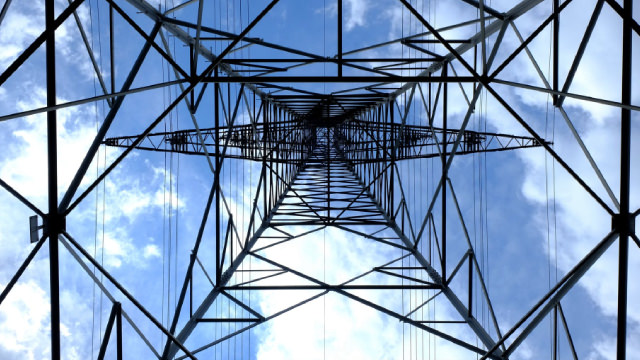

Can AES' Battery Storage Leadership Shape Grid Modernization?

AES highlights leadership in battery energy storage, from first utility-scale lithium-ion systems to major solar + storage projects, boosting grid resilience.

Why AES (AES) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Here's Why AES (AES) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

AES Stock Rises 28.6% in 6 Months: What Should Investors Do?

AES shares are up 28.6% in six months as renewables, data center PPAs and LNG projects drive growth, but high debt tempers upside.

What Moved Markets This Week

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.