The Walt Disney Company (DIS)

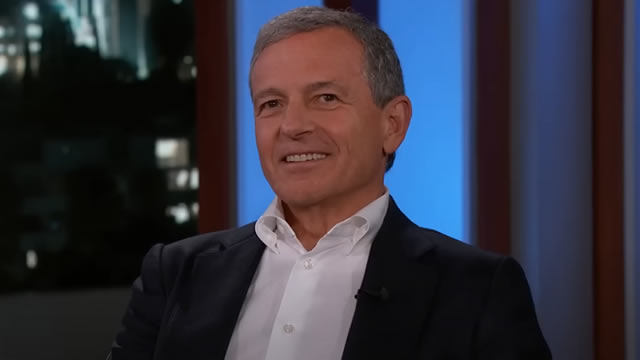

Bob Iger Equally Open To Original Or Rebooted IP, Disney's “Priority Is To Put Out Great Movies”

Disney CEO Bob Iger said new IP is of great value to the company longer term while the popularity of franchises remains high with potential sequels or bringing “them forward in a more modern way, as we've done.

Big Morning for Earnings: DIS, MCD, SHOP, UBER, etc.

We're being spared major economic reports this Hump Day, so the market can better focus on the bevy of Q2 earnings reports coming down the pike.

Disney (DIS) Reports Q3 Earnings: What Key Metrics Have to Say

The headline numbers for Disney (DIS) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Disney Q3 earnings top estimates on streaming and parks strength

Walt Disney Co (NYSE:DIS, ETR:WDP) has topped profit forecasts for the fiscal third quarter, driven by strong growth in its streaming and experiences segments, as revenue came in just shy of expectations. Revenue for the June quarter increased 2% year-over-year to $23.65 billion, slightly below Wall Street estimates of $23.7 billion.

Small Caps Rally, Disney Expands Streaming, Tech Stocks Face Pressure

Key Takeaways

Disney Is Talking With Other Sports Players About Bundles As ESPN Nears Streaming Launch, Bob Iger Says

With ESPN's long-anticipated streaming launch now just days away, Disney CEO Bob Iger says the company is exploring potential bundles with other sports programmers. “We believe there may be opportunities for us to bundle other companies' sports offerings,” Iger said during Disney's fiscal third quarter earnings call.

Walt Disney (DIS) Tops Q3 Earnings Estimates

Walt Disney (DIS) came out with quarterly earnings of $1.61 per share, beating the Zacks Consensus Estimate of $1.46 per share. This compares to earnings of $1.39 per share a year ago.

Disney gave up a ton to land 3 more NFL games. It doesn't have much choice.

In TV, there's the NFL, and everything else. That's the takeaway from the new ESPN/NFL deal, which gives the league a 10% stake in Disney's sports channel.

Bazinet: Disney is the only legacy media firm with a real streaming chance

Jason Bazinet, Media Analyst at Citigroup, tells Worldwide Exchange Disney must streamline its apps and raise guidance to meet investor expectations amid pressure on theme parks and streaming.

Why Disney Was Willing to Relinquish a 10% Stake in ESPN to the NFL

The Walt Disney Co. (DIS) late Tuesday announced a non-binding agreement for ESPN to acquire NFL Network and other NFL media assets in exchange for a 10% equity stake in the sports giant.

Disney Sees Theme Park & Streaming Profit, Studio Red Ink In FYQ2 Amid Flurry Of ESPN News

Disney's theme parks, which had a few wobbly quarters, blew past Wall Street estimates as streaming profits advanced in the June quarter, vying with red ink at the film studio on tough comps with blockbuster Inside Out 2 the year before. Total revenue rose 2% for Disney's fiscal third quarter to $23.

Disney Looks to Higher Streaming, Parks Growth

The entertainment giant is counting on the two businesses to help it deal with cord-cutting and an up-and-down movie division.