Global Technologies Ltd. (GTLL)

Venture Global, Tokyo Gas sign 20-year LNG supply deal

Venture Global said on Tuesday it has signed a 20-year sales and purchase agreement, or SPA, with Japan's capital city gas supplier, Tokyo Gas , to supply it with 1 million metric tonnes per annum of liquefied natural gas, starting in 2030.

Abacus Global Management sets first annual dividend

Abacus Global Management (NASDAQ:ABL), a firm specializing in alternative asset management, said on Tuesday that it will pay its inaugural annual cash dividend of $0.20 per share on December 17. The move marks the first time Abacus has distributed an annual dividend, which the company said aligns with its capital allocation framework of returning up to 25% of adjusted net income or up to 55% of recurring revenue to shareholders.

Petrobras to Delay Drilling Contracts Due to Global Oil Surplus

PBR reportedly delays key Buzios' drilling contracts to 2026 as it navigates a shifting oil market and pushes for more cost-efficient offshore growth.

First Eagle Global Equity ETF Q3 2025 Portfolio Update

Global Equity ETF posted a return of 1.80% in the third quarter of 2025. Leading contributors in the First Eagle Global Equity ETF this quarter included Oracle, Alphabet Inc. Class C, Samsung Electronics Co Ltd Pfd Non-Voting, Barrick Mining and Newmont Corporation. The leading detractors in the quarter were Elevance Health, Philip Morris, Shimano, Comcast Corporation Class A and Salesforce.

Siemens Energy: Positioned To Lead The Global Energy Transition

I rate Siemens Energy a Strong Buy due to its clear margin expansion, a strong backlog order book and attractive valuation. Core segments are driving consistent, profitable growth while the wind division risks are now contained. 2025 performance beat expectations across all KPIs and management raised guidance for 2026 and 2028 targeting that profit margins will doublr to 14%.

Is lululemon's Digital Push Enough to Sustain Global Momentum?

LULU leans on its surging digital ecosystem and AI-driven product reset as it works to balance global gains against U.S. softness and margin pressure.

Tech Corner: TSMC & the Global Semiconductor Trade

This week on Tech Corner, George Tsilis examines Taiwan Semiconductor aka TSMC (TSM). He looks at the company's expansion internationally and its clientele including Apple (AAPL) and Nvidia (NVDA).

M2i Global CEO discusses Nimy Resources gallium deal - ICYMI

M2i Global Inc (OTC:MTWO) CEO Alberto Rosende talked with Proactive about a major development in the critical minerals space, specifically the company's move to secure gallium supply for the US market. Rosende discussed the newly signed Memorandum of Understanding (MOU) with Nimy Resources, a company with gallium resources based in Western Australia.

Marfrig Global Foods Will Need Packaged Food Growth To Offset Commodity Pressures

Marfrig Global Foods faces near-term headwinds in U.S. beef and global poultry, but packaged foods offer long-term growth potential. MBRFY's Q3 results were resilient despite margin pressures, with revenue growth driven by strong pricing and packaged food sales offsetting volume declines. Processed foods, now 30% of revenue, are key to margin expansion and stability, with investments targeting further growth and market share gains.

Does Teladoc's Acquisition Strategy Boost Growth and Global Footprint?

TDOC's steady stream of acquisitions is expanding its global reach and lifting growth across key segments in 2025.

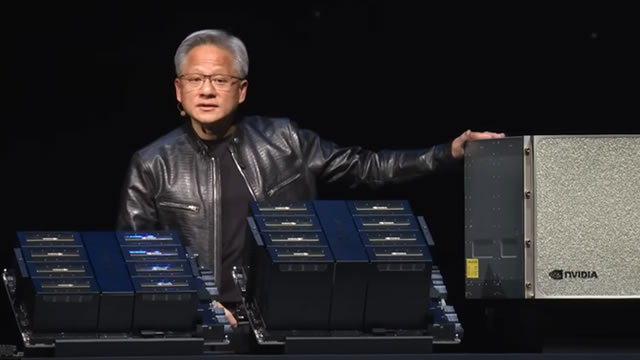

Global investors battle between long- and short-term wins amid Nvidia volatility

U.S. tech stocks saw their biggest swing in months on Thursday. It comes as AI bubble concerns continue to dominate the conversation, despite strong Nvidia earnings.

Venture Global Moves Forward With Plaquemines LNG Expansion Project

VG pushes ahead on its Plaquemines LNG expansion, filing key approvals and planning a phased buildout.