International Business Machines Corp (IBM)

IBM to Spend $150 Billion in U.S. Over Next Five Years

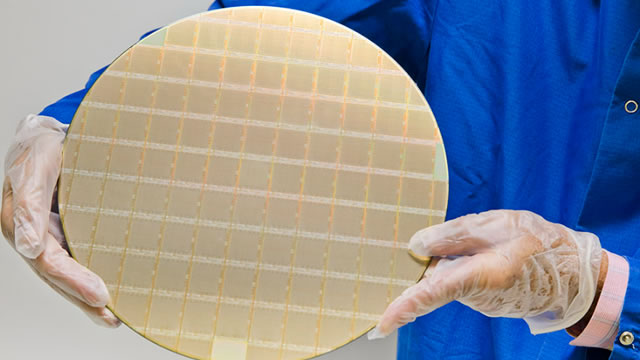

International Business Machines plans to invest $150 billion in the U.S. over the next five years as tariffs threaten to make international manufacturing more expensive.

IBM announces $150B investment in US

IBM, founded in 1911, is making a major investment in the United States over the next five years, the company announced in a media release on Monday.

IBM pledges $150 billion to boost U.S. tech growth, computer manufacturing

IBM pledges $150 billion to boost U.S. tech growth, computer manufacturing

IBM Is Back. Now It Must Prove Its Mettle in AI.

“Big Blue” has clawed its way back into investor favor, but the company needs to show staying power in AI to cement its comeback.

Buy the Dip in IBM Stock After Q1 Earnings?

IBM's (IBM) stock fell 6% in today's trading session despite beating its first-quarter expectations after-market hours on Wednesday and maintaining its full-year revenue guidance.

IBM price, Q1 earnings: Stock sinks 6% after news that Elon Musk's DOGE cuts thwarted 15 government contracts

Over the past 30 days, many big-name tech giants have seen their stock prices fall hard, largely thanks to President Trump's chaotic tariff rollout. For example, Apple (Nasdaq: AAPL) has seen its shares fall 11% over the past month, while Nvidia has seen its shares fall (Nasdaq: NVDA) over 12%.

IBM Earnings Underwhelm Investors

David Bahnsen, chief investment officer at The Bahnsen Group, says recent tech results are good news for markets but investors should still be wary of overpaying. Bahnsen joins Caroline Hyde and Ed Ludlow on “Bloomberg Technology.

IBM Stock Slides Despite Q1 Earnings Beat: Time to Buy Its ETFs?

IBM reports robust first-quarter 2025 results and offers upbeat sales outlook for Q2. The stock falls on concerns over federal contract cuts.

IBM Q1 Earnings & Revenues Beat Estimates on Solid Demand Trend

IBM reports solid first-quarter 2025 results, driven by healthy demand in the Software segment along with a client-focused, diverse portfolio.

IBM tops Q1 estimates driven by software growth

International Business Machines Corp (NYSE:IBM) saw its first quarter sales increase modestly year-over-year as its software unit offset declines in other business lines. For the quarter, revenue was up 1% at $14.5 billion, above estimates of $14.4 billion.

IBM Q1 Earnings Review: Big Blue's $6 Billion AI Flex

IBM's Q1 2025 results were strong, driven by robust performance in Software and Infrastructure, despite Consulting's drag due to macro uncertainties. Red Hat's open-source platform significantly contributed to IBM's AI and Software growth, with AI business surpassing the $6B mark, growing $1B, sequentially. Management's confidence is reflected in issuing Q2 revenue guidance above estimates, highlighting IBM's resilience amid economic uncertainties.

Wall Street Breakfast Podcast: Big Slide For Big Blue

IBM's Q1 results showed strong software revenue growth but were overshadowed by consulting declines and DOGE-related concerns. Gold steadied after a significant drop, presenting a dip buying opportunity, with central banks likely to support prices.