The Kraft Heinz Company (KHC)

Kraft Heinz cut expenses too deeply under private equity management, its new CEO says

Kraft Heinz got "too lean" after budget cuts over the past decade, CEO Steve Cahillane said. The company behind Kool-Aid and Lunchables cut costs under private-equity ownership.

The Kraft Heinz Company (KHC) Presents at Consumer Analyst Group of New York Conference 2026 Transcript

The Kraft Heinz Company (KHC) Presents at Consumer Analyst Group of New York Conference 2026 Transcript

The Kraft Heinz Company (KHC) Q4 2025 Earnings Call Prepared Remarks Transcript

The Kraft Heinz Company (KHC) Q4 2025 Earnings Call Prepared Remarks Transcript

Kraft Heinz: The Catalyst Is Gone

Kraft Heinz is rated a sell, as recent earnings and strategy shifts highlight deep structural challenges and a lack of near-term catalysts. KHC's Q4 saw a 3.5% sales decline, a $9.3B impairment, and ongoing margin pressure, with core brands like Oscar Mayer and Lunchables eroding. The paused corporate split removes a key value-unlocking catalyst; the $600M restoration plan carries high execution risk amid persistent brand and volume declines.

Kraft Heinz announces it's pausing plans to split into 2 companies. Here's why

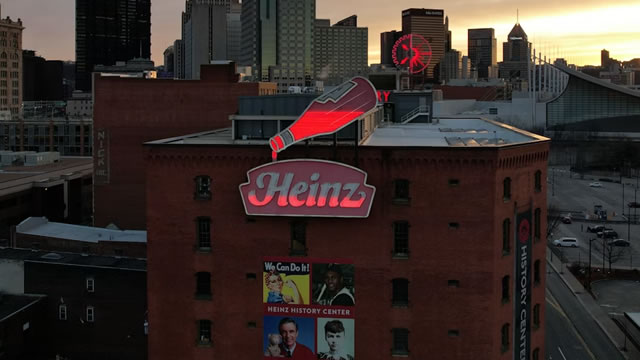

Kraft Heinz said Wednesday it's pausing its plans to split into two companies.Steve Cahillane, a former Kellogg chief who became CEO of Kraft Heinz on January 1, said he wants to ensure that all of the company's resources are focused on profitable growth.“I have seen that the opportunity is larger than expected and that many of our challenges are fixable and within our control,” Cahillane said in a statement.The company's shares dropped 5.2% in early trading Wednesday as Kraft Heinz reported lower quarterly and annual results.Kraft Heinz announced in September it was splitting into two companies a decade after a merger of the brands created one of the biggest food manufacturers on the planet.One of the companies would include stronger-selling brands such as Heinz, Philadelphia cream cheese and Kraft Mac & Cheese.

Kraft Heinz Is Ending Its Planned Split. Its CEO Thinks Its 'Challenges Are Fixable.

Kraft Heinz plans to stay together.

Nonfarm Payrolls Increased More Than Expected

Pre-market trading took a nice jump higher on this morning's long-awaited (government-delayed) non-farm payrolls report from the U.S. Bureau of Labor Statistics (BLS). That's because headline jobs numbers reached their highest single-month level since December 2024 to +130K — double what analysts had been expecting.

Kraft Heinz Q4 Earnings Beat Estimates, Organic Sales Fall 4.2% Y/Y

KHC beats fourth-quarter earnings estimates, but organic sales decline as margins shrink and volumes weaken across segments.

Kraft Heinz posts mixed Q4 earnings, pauses separation plans

Kraft Heinz Co (NASDAQ:KHC, XETRA:KHNZ) reported mixed financial results for the fourth quarter and full year 2025, along with announcing it has paused its business separation plans. For the fourth quarter, the company posted adjusted earnings per share of $0.67, exceeding Wall Street's consensus of $0.61, while revenue totaled $6.35 billion, slightly below the forecast of $6.38 billion.

Kraft Heinz CEO says company challenges are 'fixable' as breakup plans get scrapped for investment strategy

Kraft Heinz CEO Steve Cahillane scraps breakup plans, announcing a $600 million investment push to rebuild growth instead of splitting into two companies.

The Kraft Heinz Company (KHC) Q4 2025 Earnings Call Transcript

The Kraft Heinz Company (KHC) Q4 2025 Earnings Call Transcript

Kraft Heinz (KHC) Reports Q4 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Kraft Heinz (KHC) give a sense of how the business performed in the quarter ended December 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.