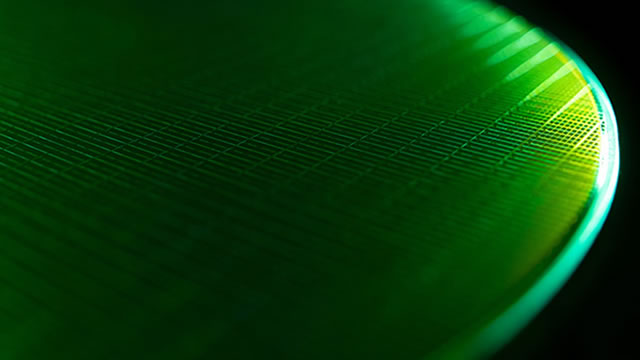

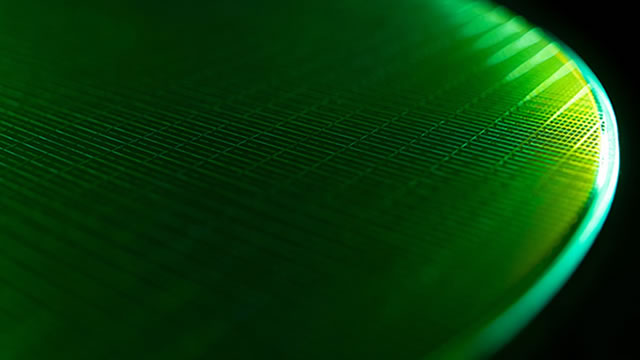

Micron Technology, Inc. (MU)

Exclusive: Micron to exit server chips business in China after ban, sources say

Micron plans to stop supplying server chips to data centres in China after the business failed to recover from a 2023 government ban on its products in critical Chinese infrastructure, two people briefed on the decision said.

Wall Street Is Even More Bullish on Micron, Seagate, and Western Digital. Here's Why.

Growing demand for artificial intelligence and persistent shortages of memory and data storage solutions could mean bigger gains for providers of the hardware, according to Wall Street AI bulls.

Micron: Growth Is Not Over Yet

Micron stands out as a leading memory producer, benefiting from AI-driven demand and Western protectionism reshaping the competitive landscape. MU's advanced HBM3E memory technology positions it as a key supplier for NVIDIA's latest AI accelerators, supporting robust and stable growth. The CHIPS Act and U.S. manufacturing grants level the playing field, giving MU a home advantage over Korean rivals as production shifts to America.

Why Micron (MU) is a Top Stock for the Long-Term

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Micron Posted A Dream Quarter - Now Let's Talk About Reality

Micron delivered a stellar FQ4 and issued bullish guidance, driven by strong DRAM demand, pricing power, and improving NAND fundamentals. MU's bit shipments and pricing both increased, supporting an ongoing upcycle, with further upside if volume growth continues alongside price strength. Strategic node transitions position MU to expand HBM market share and maintain cost advantages, supporting long-term competitiveness and margin expansion.

Micron Soars 171% in Six Months: Is MU Stock Still Worth Buying?

MU's 171% surge, AI exposure, and low valuation make it a compelling buy and a standout in the semiconductor rally.

Nvidia Stock Is Up 43% in 2025, but Here's Another Super Semiconductor Stock to Buy in 2026, According to Certain Wall Street Analysts

The artificial intelligence (AI) revolution is transforming every corner of the global economy. Nvidia, the company at the center of this revolution, continues to be a Wall Street favorite for all the right reasons.

Micron Stock A Better Bet Than Analog Devices?

Even as Analog Devices fell 5.3% during the past day, its peer Micron Technology may be a better choice. Consistently evaluating alternatives is core to a sound investment approach.

Best Growth Stocks to Buy for October 10th

MU, UGP and WDC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on October 10, 2025.

Micron vs. Texas Instruments: Which Chip Stock Is the Better Buy Now?

MU's surging AI memory demand, soaring earnings and cheaper valuation give it an edge over TXN in the chip race.

Micron Surges 5.8% In A Day — Buy Opportunity Ahead?

We think there is not much to worry about regarding MU stock based on its overall Strong operational performance and financial health. This aligns with the stock's High valuation, leading us to consider it as Fairly Priced.

Best Growth Stocks to Buy for October 9th

URBN, MU and WDC made it to the Zacks Rank #1 (Strong Buy) growth stocks list on October 9, 2025.