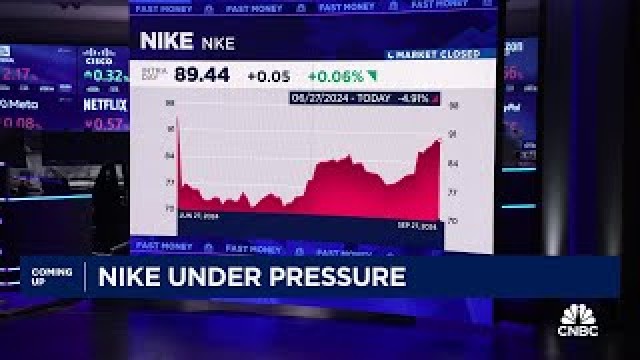

Nike, Inc. - Class B (NKE)

Powers: Elliot Hill should be a huge upswing for Nike

Matt Powers, Managing Partner at Powers Advisory Group, is optimistic about Nike's new CEO, Elliot Hill, but advises waiting for the earnings report before increasing investments. He highlights Nike's global brand and potential growth in China.

What Analysts Think of Nike's Stock Ahead of Earnings

Nike (NKE) will report fiscal first-quarter earnings after the bell Tuesday, and analysts are projecting sales and profits to decline year-over-year—but calling for little upside to the stock.

Nike Faces Headwinds: Leadership Change and Revenue Declines Loom Ahead of Earnings Report

As Nike prepares to report earnings for the first quarter of fiscal 2025 Tuesday (Oct. 1), the company faces significant hurdles marked by a leadership transition and shifting market dynamics. Elliott Hill will take over as CEO from John Donahoe on Oct.

What You Need To Know Ahead of Nike's Earnings Tuesday

UPDATE—Sept. 30, 2024: This article has been updated to reflect more recent analyst estimates and share price information.

Nike to post steepest sales drop since COVID, analysts expect target reset

Investors and analysts expect Nike to lower annual forecasts on Tuesday when it posts quarterly results, the company's first earnings report since announcing a new CEO earlier this month.

Nike Earnings Preview: New CEO Big Plus, Nike's A China Play But May Require Patience

Nike reports their fiscal Q1 '25 after the market closes on Tuesday, October 1, '24. Sell-side consensus is expecting $0.52 in EPS, roughly $878 million in operating income on $11.6 billion in revenue for expected y-o-y declines of -45% in EPS, -45% in operating income and -10% in revenue. Full-year fiscal '25 consensus is currently expecting a decline of 5% in revenue and -23% in EPS. The expected revenue decline for fiscal '25 is historic, since it's not preceded by an economic event. Nike's valuation is much more attractive on a relative basis than at any point in the last 10 years, trading at 2.1x trailing-twelve-month revenue.

Wall Street Brunch: Jobs Or Earnings?

The market is focused on inflation and jobs data, with a 50% chance of a Fed rate cut in November. Nike's earnings report is crucial, with expected revenue drops and a new CEO, Elliott Hill, starting soon.

Jobs Data, Nike Earnings, and More to Watch

The unemployment rate is expected to hold at 4.2% in September, with 145,000 new jobs. Plus, earnings from Carnival, Nike, McCormick, and Levi Strauss.

Nike is getting a new CEO. Will its earnings shed light on the path forward?

After a months-long consumer flight from new sneakers and new clothing, Nike Inc. is bringing in a new chief executive. Investors liked the news.

2 Dividend Stocks Down Over 40% to Buy Before a Rebound

Nike still has plenty of opportunities to expand in a $300 billion athletic wear industry. UPS is seeing the early signs of a turnaround, but investors can still buy the stock and get an attractive 5% yield.

Nike on deck to report earnings

Steve Grasso, Grasso Global CEO; Tim Seymour, CIO at Seymour Asset Management; Julie Biel, chief market strategist at Kayne Anderson Rudnick; and Mike Khouw, chief strategist at OpenInterest.Pr, join 'Fast Money' to discuss Nike as the company prepares to report its earnings next week.

Should NIKE Stock be in Your Portfolio Ahead of Q1 Earnings?

NKE's Q1 results are expected to reflect the impacts of soft lifestyle product trends and challenges in Greater China. Its growth initiatives appear promising.