Public Service Enterprise Group Incorporated (PEG)

Summary

Public Service Enterprise Group Incorporated (PEG) Q4 2025 Earnings Call Transcript

Public Service Enterprise Group Incorporated (PEG) Q4 2025 Earnings Call Transcript

PEG Q4 Earnings Surpass Estimates, Revenues Increase Y/Y

PSEG Q4 earnings beat estimates as revenues jump 18% Y/Y, with higher electric and gas volumes and upbeat 2026 EPS guidance.

Earnings Preview: PSEG (PEG) Q4 Earnings Expected to Decline

PSEG (PEG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Public Service Enterprise Group Incorporated (PEG) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Public Service Enterprise Group Incorporated ever had a stock split?

Public Service Enterprise Group Incorporated Profile

| Electric Utilities Industry | Utilities Sector | Ralph A. LaRossa CEO | NYSE Exchange | 744573106 CUSIP |

| US Country | 13,047 Employees | 10 Mar 2026 Last Dividend | 5 Feb 2008 Last Split | 2 Jan 1980 IPO Date |

Overview

Public Service Enterprise Group Incorporated, established in 1903 and headquartered in Newark, New Jersey, operates primarily in the United States through its subsidiaries in the electric and gas utility sectors. It is structured into two key business segments: PSE&G, focusing on the transmission and distribution of electricity and natural gas, alongside offering appliance services and energy efficiency programs; and PSEG Power, which is involved in nuclear and gas power generation. As of December 31, 2023, the company boasts extensive infrastructure including a widespread electric transmission and distribution system, several switching and substations, miles of gas mains, and a notable presence in solar energy generation.

Products and Services

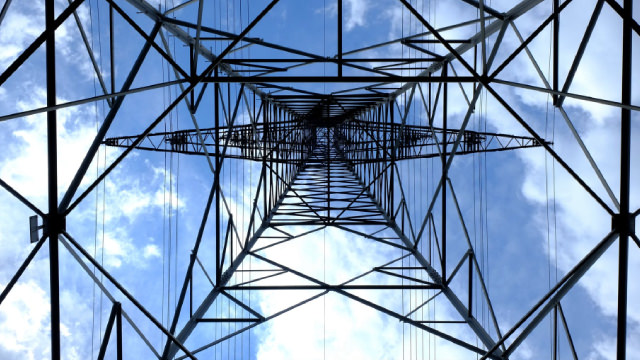

- Electricity Transmission and Distribution:

This service involves the transmission of electricity through a network of 25,000 circuit miles of lines and the distribution of electrical power to residential, commercial, and industrial customers across its service territory. The infrastructure supporting this includes 56 switching stations and 235 substations, ensuring reliable and efficient electricity supply.

- Natural Gas Distribution:

Public Service Enterprise Group provides natural gas through an extensive network consisting of 18,000 miles of gas mains. This service caters to a wide range of customers, promoting energy accessibility and reliability. The company also operates 12 gas distribution headquarters and 56 metering and regulating stations, facilitating effective gas distribution and management.

- Appliance Services and Repairs:

Offering repair and maintenance services for appliances, this segment provides essential support to residential customers, ensuring their home appliances operate efficiently and safely.

- Solar Generation Projects:

Investing in renewable energy, Public Service Enterprise Group has established 158 MegaWatts of installed PV solar capacity. These projects not only contribute to the company’s sustainability goals but also offer clean energy solutions.

- Energy Efficiency Programs:

Through various initiatives, the company promotes energy efficiency among its customers. These programs are designed to reduce energy consumption and environmental impact, supporting a sustainable future.

- Nuclear and Gas Power Generation:

The PSEG Power segment is heavily involved in the production of electricity through nuclear and gas-powered plants. This ensures a steady supply of power to meet the demands of the market, while navigating the challenges of energy generation and distribution.