PPL Corporation (PPL)

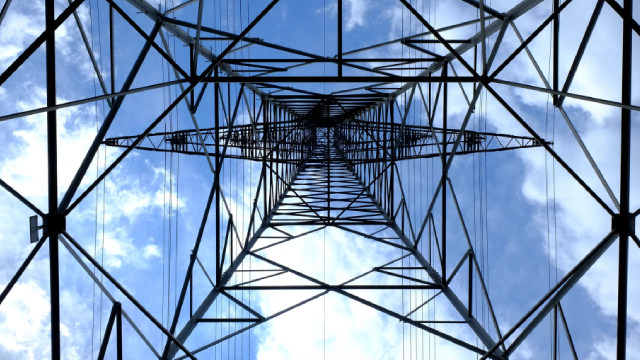

Renewable Energy & Battery Stocks to Buy Amid Expanding Energy Transition

Global renewable capacity is set to rise 4,600 GW by 2030, led by solar PV and wind growth.

PPL Gains 2.1% in Three Months: Worth Including in Your Portfolio?

PPL gains 2.1% in three months as it boosts capex to $23B, taps data center demand and targets steady dividend growth.

Compared to Estimates, PPL (PPL) Q4 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for PPL (PPL) give a sense of how the business performed in the quarter ended December 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

PPL Corporation (PPL) Q4 2025 Earnings Call Transcript

PPL Corporation (PPL) Q4 2025 Earnings Call Transcript

PPL Earnings Miss Estimates in Q4, Revenues Increase Y/Y

PPL's Q4 EPS misses estimates but revenues rise 2.8% y/y. It boosts the infrastructure plan to $23 billion and guides 2026 earnings of $1.90-$1.98.

PPL (PPL) Q4 Earnings and Revenues Lag Estimates

PPL (PPL) came out with quarterly earnings of $0.41 per share, missing the Zacks Consensus Estimate of $0.42 per share. This compares to earnings of $0.34 per share a year ago.

Is It Worth Investing in PPL (PPL) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

PPL to Release Q4 Earnings: Time to Buy, Hold or Sell the Stock?

PPL gears up for Q4 results with earnings seen up 23% and revenues rising, but premium valuation and lower ROE may keep investors cautious ahead of release.

PPL (PPL) Ascends While Market Falls: Some Facts to Note

PPL (PPL) concluded the recent trading session at $36.07, signifying a +1.09% move from its prior day's close.

Why PPL (PPL) Dipped More Than Broader Market Today

PPL (PPL) closed at $35.13 in the latest trading session, marking a -1.04% move from the prior day.

Here's Why PPL (PPL) Fell More Than Broader Market

PPL (PPL) concluded the recent trading session at $36.31, signifying a -1.06% move from its prior day's close.

PPL vs. CMS: Which Utility Stock Offers Greater Upside Potential?

CMS Energy and PPL Corporation are making investments to produce more clean energy and efficiently serve their customers.